Key takeaways

- Self-employed and freelancers must get health insurance in Germany.

- You can choose between private and public health insurance.

- You can deduct up to 2,800 € of health insurance contributions from taxes.

- Freelancers pursuing artistic or journalistic activity must get public health insurance via the Artist’s social insurance fund.

This is how you do it

- Understand the differences between public and private health insurance in Germany.

- Consult a fee-based advisor to get personalized advice.

- Public health insurance is available through Feather*. Feather offers services in English, which is helpful for expats who don’t speak German.

- Compare private health insurance plans on Check24* and Feather*.

Table of contents

Health insurance for self-employed and freelancers in Germany

Health insurance is mandatory in Germany. Self-employed and freelancers can choose between public and private health insurance in Germany.

Employees must earn more than 69,300 € (as of 2024) to be eligible to apply for private health insurance. However, there is no minimum income threshold for self-employed people.

However, freelancers pursuing artistic or journalistic activity cannot choose between private and public insurance. They are subject to artists’ social insurance (Künstlersozialversicherung in German).

Which insurance is best for you depends on your marital status, number of children, age, health, and income.

Is health insurance compulsory for self-employed or freelancers in Germany?

Yes, everyone living in Germany is legally obliged to get health insurance. If you don’t take health insurance in Germany, you’ll be liable to pay fines.

Employers ensure that their employees have valid health insurance in Germany. However, freelancers and self-employed people must take care of their health insurance themselves.

NOTE: Suppose you had compulsory public health insurance before becoming self-employed. Now you want to continue in the public healthcare system. Then, you must apply for the voluntary public health insurance within 3 months after the end of compulsory public insurance.

What health insurance is better for self-employed in Germany – public or private?

Let’s understand the differences between private and public health insurance to see which is right for self-employed in Germany.

| Statutory health insurance for self-employed | Private health insurance for self-employed |

|---|---|

| Factors on which health insurance cost depends. | |

| Public health insurance costs depend on your income, number of children, and whether you’ll opt for sick pay. Your insurance premium decreases and increases with the decrease and increase of your income. | Private health insurance costs depend on your age, health, occupation, and services you opt for. It doesn’t depend on your income. Thus, your insurance premium will remain the same even if your income decreases. |

| How much is the insurance premium? | |

| Public health insurance costs comprise two things. – Basic amount: 14% of your gross monthly income (no sick pay). 14.6% of your gross monthly income (with sick pay) – Additional contribution (Zusatzbeitrag): 1.7% of your gross monthly income Public insurance providers decide the Zusatzbeitrag. Zusatzbeitrag of some insurers like TK* is 1.2% (lower than 1.7%). And some insurers’ Zusatzbeitrag is higher than 1.7%. | Based on our research, good private health insurance plans cost between – 466 € and 683 € per month to self-employed – 301 € and 355 € per month to employees (The cost is after deducting the employer’s contributions are already deducted) – 288 € and 400 € per month to civil servants |

| Nursing care insurance cost | |

| 3.05% for self-employed people with children and 3.4% with no children | Included in the above private insurance costs. |

| Minimum monthly premium | |

| If you haven’t started earning from your business yet, you must still pay a minimum health insurance premium. As of 2024, the minimum monthly premium is between 215 € and 232 €. How is the minimum premium calculated? – Minimum income for calculating the insurance premium: 1,178.33 € [1] per month (as of 2024) Case 1 – Basic amount: 172 € (14.6% of 1178.33) – Additional contribution: 20 € (1.7% of 1178.33) – Nursing care: 40 € (3.4% of 1178.33) – Minimum monthly premium: 232 € (172 + 20 + 40) Case 2 – Basic amount: 165 € (14% of 1178.33) – Additional contribution: 14 € (1.2% of 1178.33) – Nursing care: 36 € (3.05% of 1178.33) – Minimum monthly premium: 215 € (165 + 14 + 36) | It depends on age, health, occupation, and the services you opt for. |

| Maximum monthly premium | |

| There is a maximum limit on how much gross income public insurers can consider when calculating the premium. It is 5175 € as of 2024. Thus, the maximum monthly premium in public health insurance is between 944.5 € and 1019.5 €. | It depends on age, health, occupation, and the services you opt for. |

| Family health insurance | |

| Your spouse (if they don’t have any income) and children are covered for free under your public health insurance. | You must take a separate health insurance policy for your spouse and each child. |

| What happens if I am unemployed or have no income? | |

| If you receive “Unemployment Benefit I” from the job center, you remain insured with your public health insurance provider. Your insurer will get the monthly contribution directly from the job center. If you don’t get “Unemployment Benefit I,” you can voluntarily insure under statutory health insurance. In this case, you must pay the minimum insurance premium, which is 215 € and 232 € per month. | – If you receive “Unemployment Benefits I,” you’ll automatically be covered by statutory health insurance, even if you previously had private insurance. – You cannot switch to statutory health insurance if you are 55 and over. It doesn’t matter if you receive “Unemployment Benefit I.” – You can stay with your private health insurer after being unemployed if you have private insurance for five years before becoming unemployed. The job center pays a subsidy for your health insurance contributions. – Privately insured people who receive “Unemployment benefit II” remain in private health insurance. You get a subsidy from the job center. |

| Sickness benefits | |

| Your basic amount increases from 14% to 14.6% if you opt for sickness benefits. Sickness benefits are paid by the public health insurance company when you are sick for the long term. You get sick pay from the 43rd day of your illness. You can take an optional tariff if you want to start getting paid earlier. You can compare different daily sickness benefits insurance on the comparison portal Check24*. | While choosing private health insurance, you can decide on the daily sickness allowance and when to start getting it. |

| Changing health insurance plan with the same provider | |

| Statutory health insurance providers have standard coverage and don’t offer multiple plans. Of course, you can take supplementary private health insurance on top. | You can switch to a new health insurance plan offered by your insurer. However, the insurer may demand a complete health check. Depending on the health check results and services in the new tariff, your health insurance premium might be higher than the older tariff. |

| Changing health insurance provider | |

| You can change your public health insurance provider anytime. | Changing private health insurance providers in Germany is expensive. – You lose a large part of your saved retirement provisions. – A new health insurer will demand a complete health check. Hence, it might lead to higher insurance costs. – You usually pay a higher premium to the new insurer as you age. |

| Switching between private and public health insurance in Germany | |

| You can switch from public to private health insurance anytime. | Returning to the public health insurance system is tough. It’s almost impossible for people 55 and older to make the switch. |

Conclusion: The right health insurance for self-employed in Germany

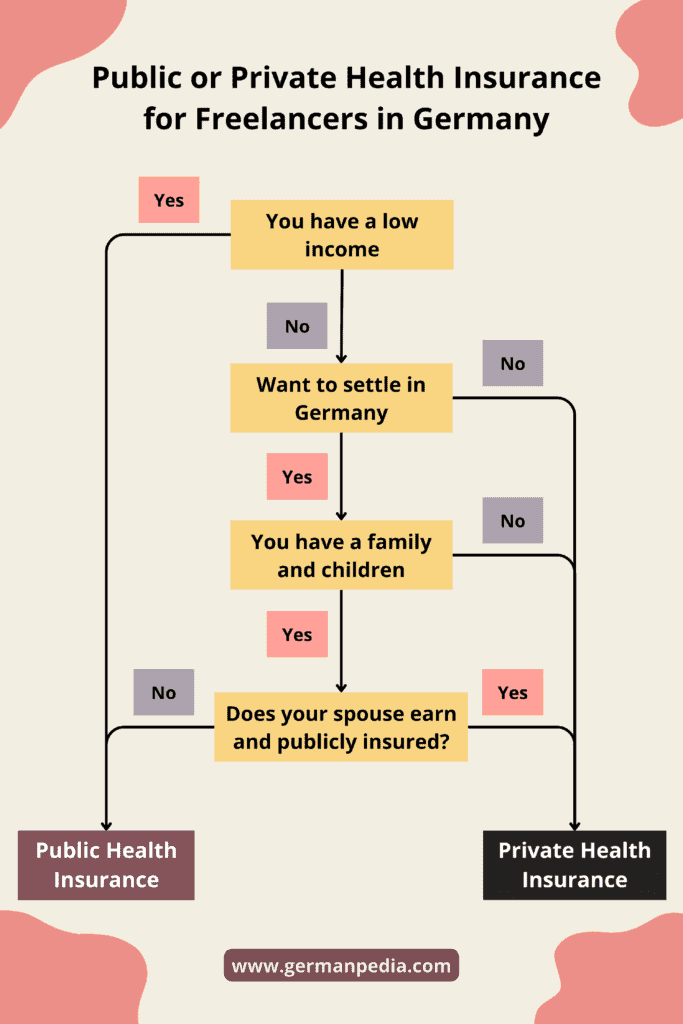

Private health insurance is popular among the self-employed because you can save between 200 and 500 € per month. We created the below flow diagram to make choosing between private and public insurance easier.

In the following scenarios, private health insurance makes sense for the self-employed

Scenario 1

- You are not planning to settle in Germany.

- You have an average or high income.

You are in Germany temporarily. So, you don’t have to worry about increased insurance premiums in old age.

And if you earn more than the income threshold, you save between 290 € and 500 € per month with private health insurance. But it’s the gross savings. You must also deduct income tax on this amount.

Assuming you earn more than 62,000 €, your personal income tax rate will be 42%. Thus, your net savings will be between 168 € and 290 € per month.

Hence, taking out private health insurance in this case makes sense.

Scenario 2

- Your spouse is employed and insured with public health insurance.

- Your spouse is the main earner, i.e., they earn more than you.

- You earn more than the maximum income limit of public insurance (5175 € gross per month as of 2024).

Your spouse is employed and can, hence, take care of their health insurance. Moreover, your children can be insured for free under your spouse’s public insurance.

Feather – Private health insurance

- Insurance service provider with customer support in English

- Can apply for the health insurance online

- Get free consultation in English

Tarifcheck – Compare private health insurance

- Compare offers and prices.

- Comparison calculator to find suitable private health insurance policies.

- Compare the insurance providers and their ratings.

In the following scenarios, statutory health insurance makes sense for the self-employed

Scenario 1

- You have a low income

The premium for public health insurance depends on income. Thus, it makes sense to get it if you have a low income.

Scenario 2

- You have an average or high income.

- You plan to stay in Germany.

- You have a family and children. But your spouse doesn’t earn.

Private health insurance doesn’t cover your spouse and children for free. Thus, you must take a separate insurance policy for them.

After adding the cost of your family’s health insurance, taking private health insurance gets expensive.

Moreover, you must consider the long term. Your private insurance premium will increase as you age. If your business performs poorly, you’ll be unable to afford high premiums.

Hence, staying in the public healthcare system in this scenario is better.

Get Public Health Insurance in Germany via Feather

- Get public health insurance in Germany from one of the four insurers.

- Complete the application process in English.

- Public insurance is the best choice for most expats living in Germany.

How do you get health insurance as a self-employed or freelancer in Germany?

Public health insurance for self-employed persons and freelancers in Germany

You have two ways to get a statutory health insurance policy in Germany:

- Via insurance broker or agent

- Directly from the public health insurance company.

If you don’t speak German, you can get public health insurance via Feather*. Feather offers services in English and a free health insurance consultation.

You can also apply directly on the public insurer’s website. Many health insurance providers in Germany have websites in German and English.

TK even provides customer service in English. However, you must expect a longer waiting time for English service.

Private health insurance for freelancers in Germany

There are many private health insurance providers in Germany. Thus, it’s best to compare the offers on the comparison portal Check24*.

We recommend getting advice from a fee-based advisor before choosing private health insurance.

Statutory health insurance coverage in Germany

The German government regulates public health insurance coverage per the Fifth Social Law.

The law states that the publicly insured person is entitled to adequate, needs-based medical treatment corresponding to the generally recognized state of medical science. This includes

- medical treatment,

- dental treatment,

- psychotherapeutic treatment,

- the supply of medicines, bandages, remedies, aids,

- home nursing care,

- hospital treatment,

- medical rehabilitation services, and other services.

The law specifies that medical services must be sufficient, appropriate, and economical. Services must not exceed what is necessary.

Every public health insurance provider must offer services regulated by law. Thus, there is little difference in the services different public health insurance providers offer.

Private health insurance coverage in Germany

Private health insurance companies offer many plans, from basic to comprehensive coverage. Thus, it is critical to check and compare the services before signing the health insurance contract.

Here are some essential services a good private health insurance should cover.

- Doctors’ fees

- Freedom to select the doctor

- Low deductible

- Check if there are any reimbursement limits.

- Your private health insurance provider should cover the cost of both generic and non-generic medicines.

- What life support and physical aids do your private insurance cover?

- Dental benefits

- Ensure that the psychotherapy coverage in your private health insurance matches that of your public insurance.

- What type of therapies does your health insurance plan cover?

You can download our checklist to ensure your policy covers the minimum recommended services.

Private health insurance services checklist

- A comprehensive list of services good private insurance should cover.

- Use it during your consultation with the fee-based advisor.

- Use it while searching for a private health insurance policy.

FAQs

Can you switch from Private to Public Health Insurance in Germany?

Switching from private to public health insurance is difficult. And it gets tougher as you grow old.

There are a few ways to return to the public healthcare system. For example,

- Your salary goes below the amount required for private health insurance. It’s 69,300 € (as of 2024).

- You get unemployed and receive “unemployment benefit I.”

- You are unemployed and want to be insured under your spouse’s public health insurance.

In our guide, you can learn more tips on returning to statutory health insurance.

Can freelancers and self-employed deduct health insurance premiums from taxes?

Yes, the contributions to the health insurance are tax deductible. You can deduct up to 2,800 € of health insurance contributions from taxes.

Self-employed Part-time Regulations

If you are employed full-time and self-employed part-time, your health insurance via employment will continue. However, you must inform the health insurance company about your part-time self-employment.

The health insurer will determine whether your self-employed work is part-time. If the health insurer determines it’s not part-time, your compulsory public health insurance via employment will end.

You must take out voluntary public health insurance or private insurance. Your employer will stop contributing to your health insurance premiums in this case.

Similarly, if you are unemployed and self-employed part-time, you can continue to be covered under your spouse’s public health insurance. But as soon as you earn above the minimum amount, you must voluntarily insure under statutory health insurance or get a private insurance policy.

Emergency health insurance tariff for self-employed and freelancers

Privately insured self-employed and freelancers who cannot pay insurance premiums anymore fall into the emergency tariff. In emergency tariff, you get the minimum health services.

But as soon as you can afford the health insurance premiums, you must return to your original tariff.

You should consider reducing your private health insurance premium if you cannot afford it. The easiest way to do so is by switching to a cheaper tariff offered by your insurance provider.

What is the Künstlersozialkasse?

The Artists’ Social Fund (Künstlersozialkasse (KSK)) is an organization that checks your eligibility to join the fund. It also collects health insurance premiums and forwards them to the relevant public health insurance providers.

You can get health insurance via the artists’ social insurance fund if you

- do artistic or journalistic activity commercially,

- you do not employ more than one employee (except for trainees and mini-jobbers),

- you earn at least 3,901 € per annum (more than 325 € per month) from your artistic work.

The benefit of getting health insurance via the artist’s fund is you only pay half of the health insurance premiums. Besides, you are legally obliged to insure via the KSK if you are self-employed and doing artistic or journalistic activity.

Read our guide on artists’ social insurance fund to learn more.

References

- https://www.bundesgesundheitsministerium.de/service/begriffe-von-a-z/l/leistungskatalog

- https://selbststaendigkeit.de/versicherungen-selbststaendige/nebenberuflich-selbststaendig-krankenversicherung/

- https://blog.orgamax.de/unternehmer-news/selbstst%C3%A4ndig-und-gleichzeitig-angestellt-welche-krankenversicherung

- https://www.finanztip.de/krankenversicherung/fuer-selbststaendige/

- https://www.lexware.de/wissen/buchhaltung-finanzen/krankenversicherung-fuer-selbststaendige/

- https://www.knappschaft.de/DE/VersicherungBeitraege/MeineKVPV/Selbststaendige/Selbststaendige.html