Key takeaways

- Private health insurance costs depend on your age, health, and the insurance services you opt for.

- Public health insurance costs depend on your income.

- A good private health insurance costs between

- 466 € and 683 € per month to self-employed

- 301 € and 355 € per month to employees

- 288 € and 400 € per month to civil servants

- 120 € and 220 € per month for students

- Private health insurance doesn’t cover your family for free. You must get separate health insurance for your spouse and children.

- You can insure your non-working spouse and children for free with public health insurance.

This is how you do it

- You should know what good private health insurance covers before signing a contract.

- Private insurance is not automatically better than public. Compare them to weigh in the pros and cons.

- Always consult a fee-based advisor for personalized advice.

- You can compare various private health insurance plans on the comparison portal Check24*. You can also check private insurance from Feather*. Feather offers services in English.

Table of contents

Costs of health insurance in Germany

Cost of public health insurance in Germany

The cost of public health insurance depends on your income.

Employed

Employees pay 14.6% of their gross income into the public health insurance system every month. On top of it, there is an additional contribution (Zusatzbeitrag in German).

The public health insurance company determines the additional contribution.

The public insurer put a limit on the maximum public insurance premium. The maximum limit on the income to be considered for calculating the insurance cost is 5175 € per month (as of 2024).

Thus, the maximum monthly premium you pay is 756.45 € per month (14.6% of 5175 €).

You also contribute to the nursing care insurance. People with children pay 3.4% of their gross income into nursing care insurance. And people with no children pay 4%.

The good news is that the employer pays half the nursing care insurance premium.

Self-employed

Self-employed pay 14% of their gross income into the public healthcare system. They must also pay the additional contribution (Zusatzbeitrag) and nursing care insurance like the employees.

However, self-employed must cover the complete health insurance cost on their own.

The insurance premium increases to 14.6% if you opt for sick pay.

| Have kids and no sick pay | No kids and no sick pay | Have kids and with sick pay | No kids and with sick pay | |

| Health insurance | 14.0% | 14.0% | 14.6% | 14.6% |

| Average Additional contribution | 1.7% | 1.7% | 1.7% | 1.7% |

| Nursing care insurance | 3.05% | 3.4% | 3.05% | 3.4% |

| Total contribution | 18.75% | 19.1% | 19.35% | 19.7% |

Civil servant

Civil servants pay 14% of their gross income to public healthcare insurance. They must also pay the additional contribution (Zusatzbeitrag) and nursing care insurance like the employees.

Like self-employed, civil servants must cover the whole insurance cost on their own. However, some federal states cover half the insurance costs.

Cost of private health insurance in Germany?

Private health insurance premiums don’t depend on your income. The insurance cost is based on the following factors.

- Age: The older you are, the more expensive the private insurance plan

- Health: Private health insurance providers do a complete health check before accepting a new customer. The premium for private health insurance is lower for healthy individuals. A private insurer adds a risk surcharge to your insurance premium if you have an existing disease.

- Services: You can select which services you want in your health insurance. The better services you opt for, the more the private insurance cost.

We used Check24* to find the cost of different private health insurance plans in Germany.

Here are our assumptions while looking for a private health insurance policy.

- You have no prior health problems

- You are 35 years old

- You earn more than 69,300 € (as of 2024) gross annually.

The filters we used during our search

- We set the maximum deductible to 500 € per annum.

- The daily sickness allowance should be at least 100€ paid from the 43rd day.

- Shared room or 2-bed room in the hospital.

The private health insurance premium varies based on your occupation. You can find the result below.

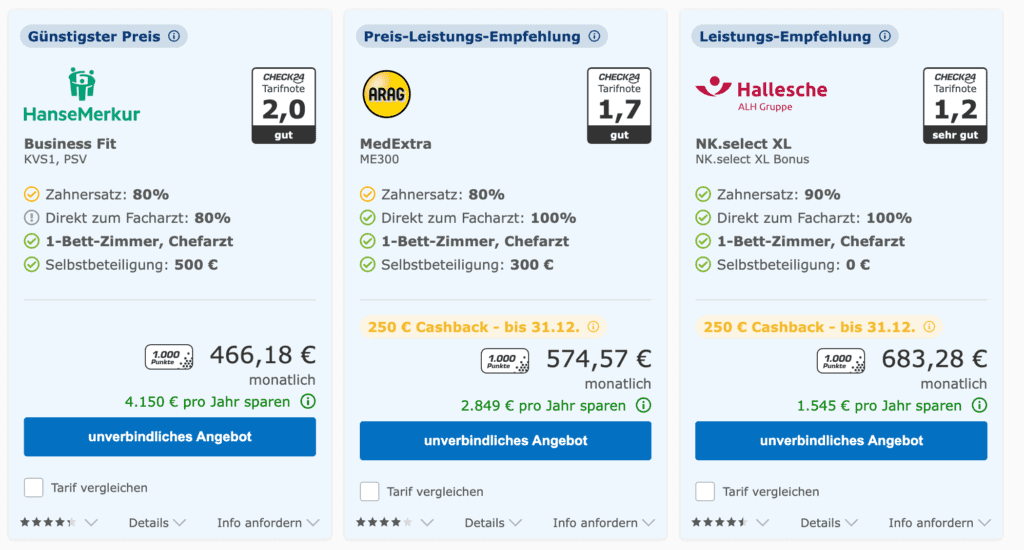

Self-employed

The private health insurance cost between 466 € and 683 € per month (as of Apr 2024).

At this cost, you get the following services.

- The private insurer reimburses 80% to 90% of the dental treatment costs.

- You can go directly to a specialist. You don’t need a “Überweisung” from the general practitioner (Hausartz).

- The deductible is zero for “premium” private health insurance plans that cost 683 € per month. And it’s 300€ and 500 € for cheaper plans.

- The private health insurance provider will reimburse the cost of a 1-bed room during your stay at the hospital.

- The head doctor will treat you in the hospital.

NOTE: Just because your insurance provider reimburses the costs of a head doctor doesn’t mean the doctor will be available to treat you.

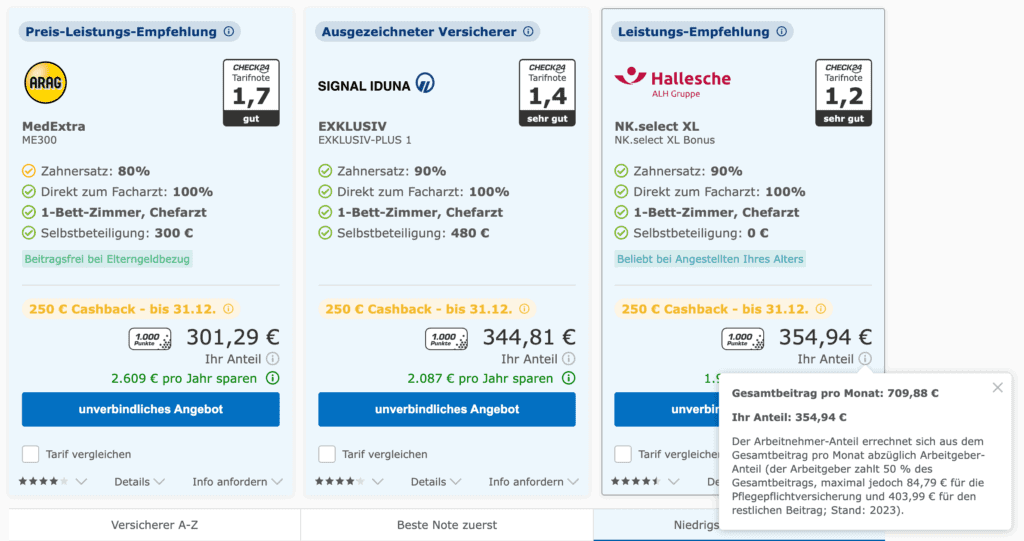

Employed

The private health insurance cost between 301 € and 355 € per month (as of Apr 2024) for employees. Private health insurance premiums are low as your employer pays half.

So, in reality, private health insurance costs between 602 € and 710 € per month. At this cost, you get the same services as the self-employed.

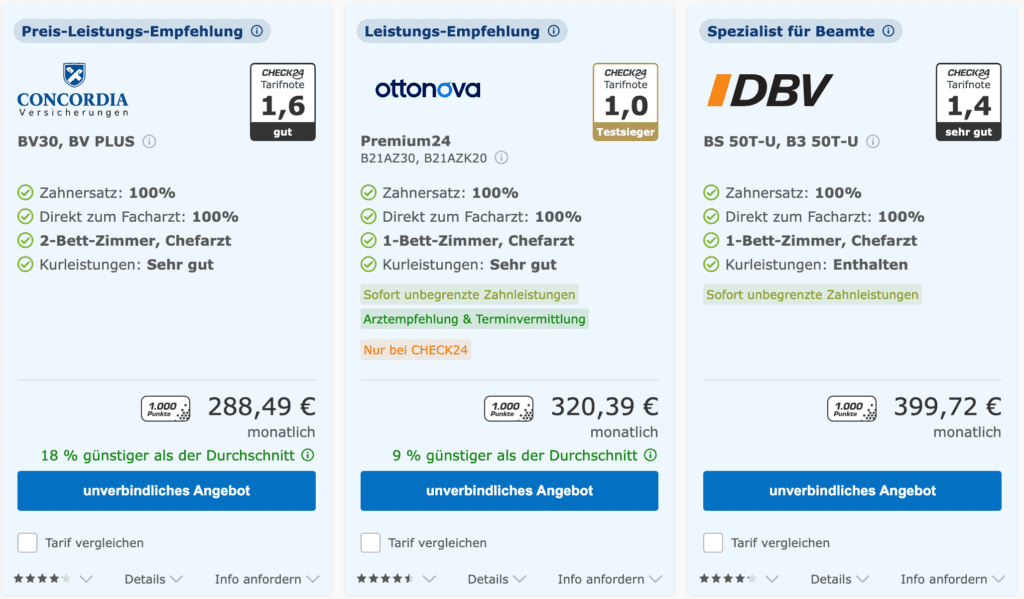

Civil Servant

The federal state covers 50% to 70% of civil servants’ medical bills. Thus, civil servants need health insurance for the part of the costs not covered. This makes private health insurance very cheap for civil servants.

Assuming you get a 50% subsidy from the state, you pay between 288 € and 400 € per month into the private health insurance system.

Civil servants not only get cheaper insurance but also better services.

- 100% dental coverage

- Visit a specialist directly

- 1-bed room during hospital stays

- Treatment by the head doctor

If you plan to get private health insurance, you should do so before you turn 45. We have created a checklist you can use to ensure that your private health insurance plan has all the essential services.

Private health insurance services checklist

- A comprehensive list of services good private insurance should cover.

- Use it during your consultation with the fee-based advisor.

- Use it while searching for a private health insurance policy.

Family health insurance premium in Germany

Public health insurance premium for a family

Your spouse and children are covered for free under statutory health insurance. The prerequisite is that your partner doesn’t earn or earns below 505 € gross per month (as of 2024).

If you both earn, you and your partner must pay 14.6% of your gross income into the public health insurance system.

Private health insurance premium for a family

In a private health system, you must take out a separate health insurance policy for each family member. Moreover, you must continue paying the private health insurance premium during maternity leave.

So, private health insurance gets expensive quickly for families. However, the situation is different for the civil servant’s family.

The state gives civil servants an 80% subsidy for children and 70% for spouses on private health insurance.

Increase in health insurance cost

Thanks to inflation, medical treatment costs are increasing and will continue to rise in the future. Thus, an increase in health insurance costs is inevitable.

The difference is how the insurer will calculate the health insurance costs.

Increase in the public health insurance cost

The statutory health insurance premium increased by 3.2% annually from 2004 to 2024. And 3.3% annually from 2014 to 2024. [1]

Increase in the private health insurance cost

The private health insurance cost increased by 2.8% annually from 2004 to 2024. And 3.2% annually from 2014 to 2024. [1]

| Year | Increase in the public health insurance cost | Increase in the private health insurance cost |

| 2004 to 2024 (Two decades) | 3.2% annually | 2.8% annually |

| 2014 to 2024 (One decade) | 3.3% annually | 3.2% annually |

How do you interpret the increase in health insurance costs?

As you can see, public insurance costs increased more than private insurance. However, you must understand how the costs of the two healthcare systems are calculated.

Each year, the German government increases the maximum income public insurers consider when calculating the premium. This, in turn, increases the premium of people earning above that threshold.

So, if your income is not increasing or the worst decreases, your public insurance premium will stay almost the same or reduce with your income.

On the other hand, private health insurance costs don’t depend on your income. So, even if your income is not increasing, the insurance premium will continue to rise.

This is why you should always consider the long-term perspective when deciding between private and public insurance.

How do health insurance costs develop as you get older?

Germany has an aging population. Rising medical costs and the aging population have put pressure on its health insurance systems.

Hence, it’s safe to assume that health insurance costs will continue to rise.

Public health insurance

Statutory health insurance costs depend on your income. So, you pay less premium after retirement, assuming you earn less when you retire than when you were working.

Private health insurance

Private health insurance premiums will continue to rise, and you’ll pay more premiums after retirement than you do today.

To worsen the situation, the German pension system is struggling due to the aging population. One can already see that the pension will not be enough to cover your current lifestyle. So, paying increased health insurance premiums will become even more challenging in old age.

Thus, the German government made it compulsory for every private health insurance provider to save part of the insurance premium for retirement. It is called the retirement provisions.

As per the law, insurers must save at least 10% of the premium.

So, you pay the retirement provisions between the ages of 22 and 61. The insurer uses the saved amount to stabilize the insurance premium when you are 62 or older.

NOTE: The German government has put guardrails in place to ensure private insurance companies don’t increase their customers’ premiums too much. So, to increase your premium, the insurer must prove that your medical expenses are at least 5 -10% higher than what they calculated when signing the contract.

The law enables a stable private health insurance premium. However, premium adjustments are common in the private healthcare system.

Thus, privately insured people must save up a financial cushion for old age. The cushion will supplement their pension and help pay increased health insurance premiums.

Can you reduce the costs of health insurance in Germany?

Public health insurance

Statutory health insurance costs depend on income. If you are a high earner and don’t want to pay high premiums, you can switch to private health insurance.

Another option is to switch public health insurance providers. Each public insurer is free to set an additional contribution percentage.

So, you can reduce your public insurance premium by opting for an insurer with a lower additional contribution percentage.

Tk is Germany’s largest public health insurance company, with 8.43 million members (as of 2022). It also charges a low additional contribution (Zusatzbeitrag), i.e., 1.2% (as of 2024).

In comparison, the average additional contribution in Germany is 1.7%.

You can easily switch to TK via Feather*. Feather offers English support and digital onboarding.

Get Public Health Insurance in Germany via Feather

- Get public health insurance in Germany from one of the four insurers.

- Complete the application process in English.

- Public insurance is the best choice for most expats living in Germany.

Private health insurance

Here are the options to reduce the private health insurance premiums.

- Switch to a cheaper tariff. A private health insurance company offers several insurance plans. So, you can always switch to a cheaper plan to reduce your monthly premium.

- Cancel services you don’t use from your private health insurance contract.

- Increase your deductible

- You can ask for a risk surcharge reassessment (Risikozuschlägen). Insurance companies add a risk surcharge for pre-existing conditions. So, you reduce your premium if your previous illnesses are now cured.

- Return to statutory health insurance.

Learn more in our guide on reducing private health insurance costs in Germany.

How do you pay medical bills in Germany?

Statutory health insurance members

In Germany, every public health insurance member gets a health insurance card. When you go to a doctor, you show your health insurance card for treatment. So, you don’t pay anything.

If you avail of a treatment not covered by public insurance, the clinic issues you a bill that you must pay. For example, professional teeth cleaning.

Of course, the doctor informs you in advance if the treatment is covered by public insurance.

The same applies to buying medication. Usually, the prescribed medication is covered by public health insurance, and you don’t pay anything at the pharmacy.

You have to pay a small amount per quarter for prescribed medicines. Over-the-counter medication is not covered in public insurance.

Private health insurance members

- Outpatient: Doctors give you a receipt for outpatient treatments. You must pay the medical bill within 10 to 14 days. You must submit the receipt to your private health insurance provider for reimbursement. Usually, the insurer reimburses the cost within a few days. But you are responsible for settling the medical bill.

- Pharmacy: At pharmacies, you must also pay the bill yourself. Later, you can submit the receipt to your private health insurer for reimbursement.

- Inpatient: Usually, the hospital can settle the treatment costs directly with the health insurer. However, sometimes, you might have to pay the bill and get reimbursed later.

We recommend consulting with your insurer before getting expensive medical treatment. Sometimes, the insurance provider doesn’t cover all the costs. So, it’s better to know what is covered and what isn’t to avoid surprises.

When does switching to private health insurance make sense in Germany?

Moving to private health insurance is a lifelong decision. So, you should consult a fee-based advisor before making the decision.

You should educate yourself about the German healthcare system and then decide.

In general, private health insurance makes sense in the following situations.

- You are a young single high-earner temporarily living in Germany.

- You are a civil servant who gets a 50% to 70% subsidy from the state.

- You are a high-earning, self-employed who doesn’t plan to have a family.

It’s tough to generalize. Hence, always consult a fee-based advisor for personalized advice.

You should also compare public and private health insurance to weigh the pros and cons better.

Feather – Private health insurance

- Insurance service provider with customer support in English

- Can apply for the health insurance online

- Get free consultation in English

Tarifcheck – Compare private health insurance

- Compare offers and prices.

- Comparison calculator to find suitable private health insurance policies.

- Compare the insurance providers and their ratings.

References

- https://www.wip-pkv.de/veroeffentlichungen/detail/entwicklung-der-praemien-und-beitragseinnahmen-in-pkv-und-gkv-aktualisierung-20232024.html

- https://www.bundesgesundheitsministerium.de/private-krankenversicherung

- https://www.check24.de/private-krankenversicherung/kosten/

- https://www.finanztip.de/pkv/pkv-kosten/

- https://www.transparent-beraten.de/gesetzliche-krankenversicherung/berufsgruppen/beamte/

- https://versicherungsvergleich-beamte.de/beamte-in-der-gesetzlichen-krankenkasse