Understand how private pension schemes in Germany function. Is it worth getting a private pension policy alongside the statutory pension plan? Learn about the risks and alternatives of private pension insurance in Germany. Plan your retirement with the right pension plan in Germany.

Key takeaways

- Taking a private pension in Germany is not worth it due to high costs, low returns, inflexibility, and risks. Investing in broad market ETFs or real estate is better than taking private pension insurance in Germany.

- Riester, Rürup, and company pension plans are often categorized under private pension insurance. But all three of them differ from classic private pension plans in Germany regarding state benefits, tax benefits, employer contributions, etc.

- Usually, private pension providers invest part or all of your contributions in high-risk investments.

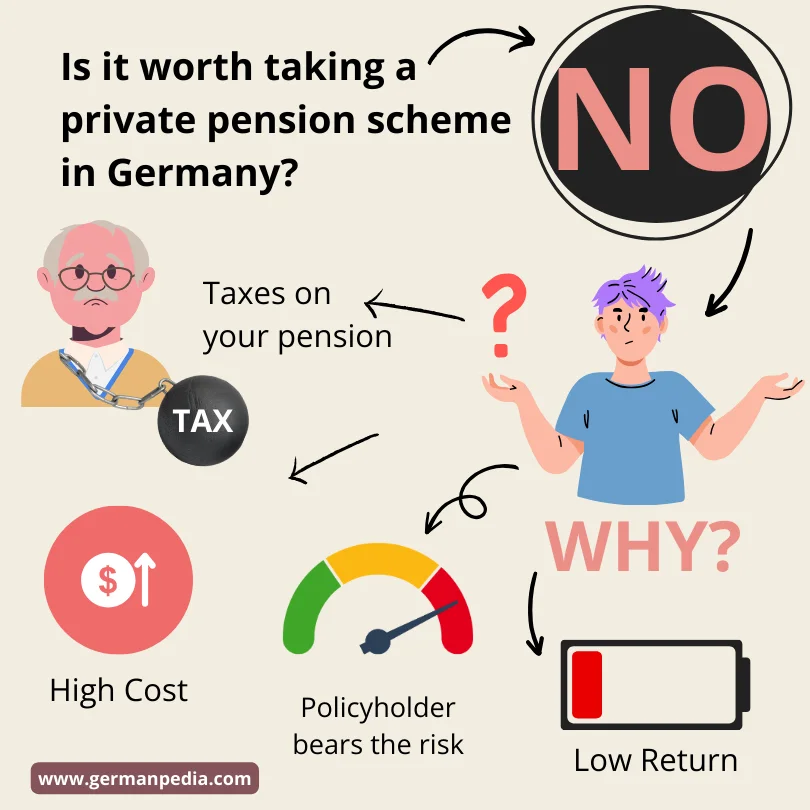

- There are no significant tax advantages for taking a private pension policy.

This is how you do it

- You can open a free ETF savings plan with one of the German brokers and invest a fixed amount in broad market ETFs every month. You can open one with Scalable Capital* for free.

- Another alternative is to buy real estate in Germany.

- If you think a private pension is the best option for you, you can compare different private pension plans on Check24*.

Table of Contents

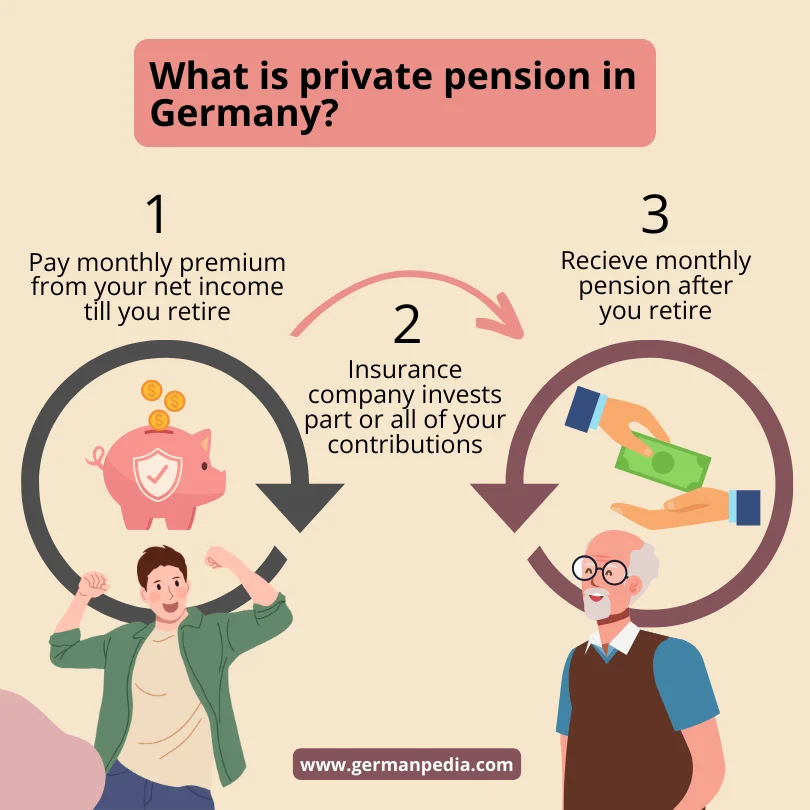

What is a private pension in Germany?

Generally, you pay a monthly premium in a private pension plan until you retire. In return, the private pension provider promises a monthly pension after you retire.

Private pension companies invest part of or all your contributions in stocks, bonds, and real estate to keep up with inflation. But no pension insurance company guarantees a return.

Of course, some variations make each pension policy slightly different from another. However, the idea is the same.

The reason private pension schemes exist is the fact that the state pension benefits are not sufficient to support your living standard after retirement.

Is it worth taking a private pension scheme in Germany?

No, it’s not worth taking a private pension plan due to high costs and low returns. Also, the risks associated with private pension policies are not worth the return.

Instead, invest your money in ETFs via an ETF savings plan. Many brokers in Germany offer ETF savings plans. You can also open a free ETF savings plan in Scalable Capital*.

What pension options are available in Germany?

In Germany, you have 5 major pension schemes.

- Statutory pension scheme (Mandatory)

- Private pension plan

- Riester pension plan

- Rürup pension plan

- Company pension plan

Many people consider Riester, Rürup, and company pension plans part of the private pension as private insurance companies offer these plans. However, they are completely different from private pension plans regarding how they work, state subsidies, tax benefits, risks, and employer contributions.

You can learn more about the German pension system in our guide, “Pension in Germany.“

German Pension System

- The German pension system is based on three pillars.

- The first pillar covers basic pension benefits. It includes state pensions like statutory pension insurance, professional pension schemes, and the Rürup pension.

- The second pillar comprises subsidized pension provisions. It includes company pension schemes and Riester contracts. The second pillar primarily aims at employees.

- The third pillar refers to unsubsidized pension plans. It includes private pensions like life insurance or private pension insurance.

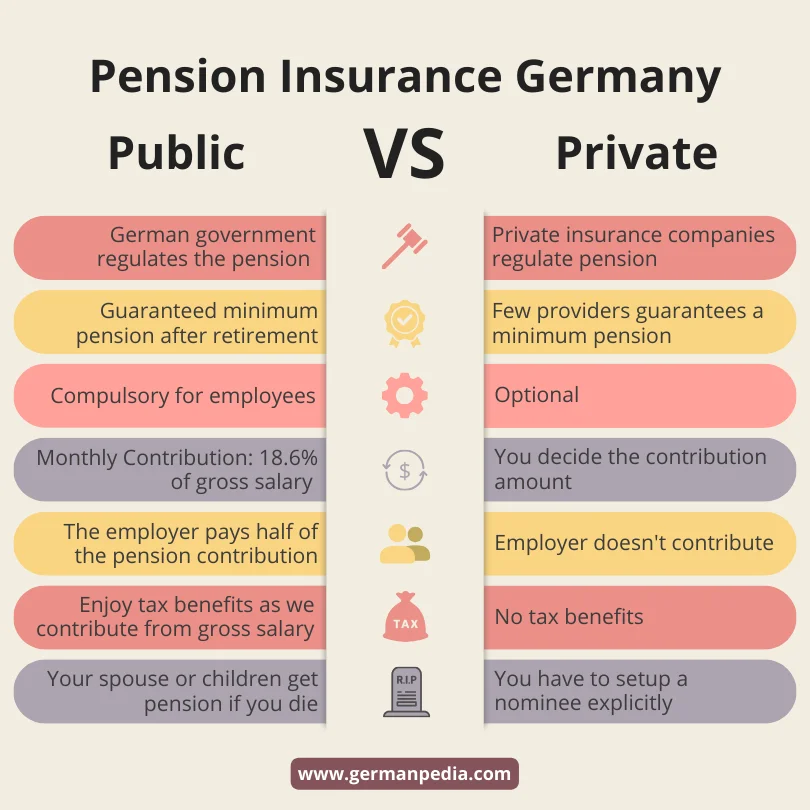

Differences between private and public pension in Germany

| Features | Public Pension Insurance | Private Pension Insurance |

|---|---|---|

| Who regulates the pension plan? | The German government regulates the public pension system. | Private insurance companies regulate pension schemes. |

| Minimum pension guarantee | The state pension system guarantees a minimum pension after retirement. | Not every private pension provider guarantees a minimum pension after retirement. |

| Compulsory vs. optional | Taking public pension insurance is compulsory for employees. Self-employed can voluntarily take public pension insurance in Germany. | Taking a private pension plan is optional. |

| Monthly contributions | As of 2023, every employee contributes 18.6% of their gross salary to the state pension system. The employer pays half of that pension contribution. | You can decide how much you want to contribute to a private pension. |

| Tax benefits | You enjoy tax benefits on your public pension contributions as you pay the contributions from your gross salary. | You don’t enjoy any tax benefits as you pay the private pension contributions from your net income. Hence, you have already paid the income tax. The only tax benefit is you don’t pay taxes on income from dividends or interests. |

| Employer contribution | Your employer pays half of the pension contribution. | No contribution from your employer. |

| In the event of death | Your spouse gets the pension. If both parents die, children get a pension until they are 18. Children enrolled in study receive a pension until they are 27. | You have to set up a nominee or beneficiary while signing the contract. By default, a private pension company distributes your capital among other policyholders. |

Types of Private Pensions in Germany

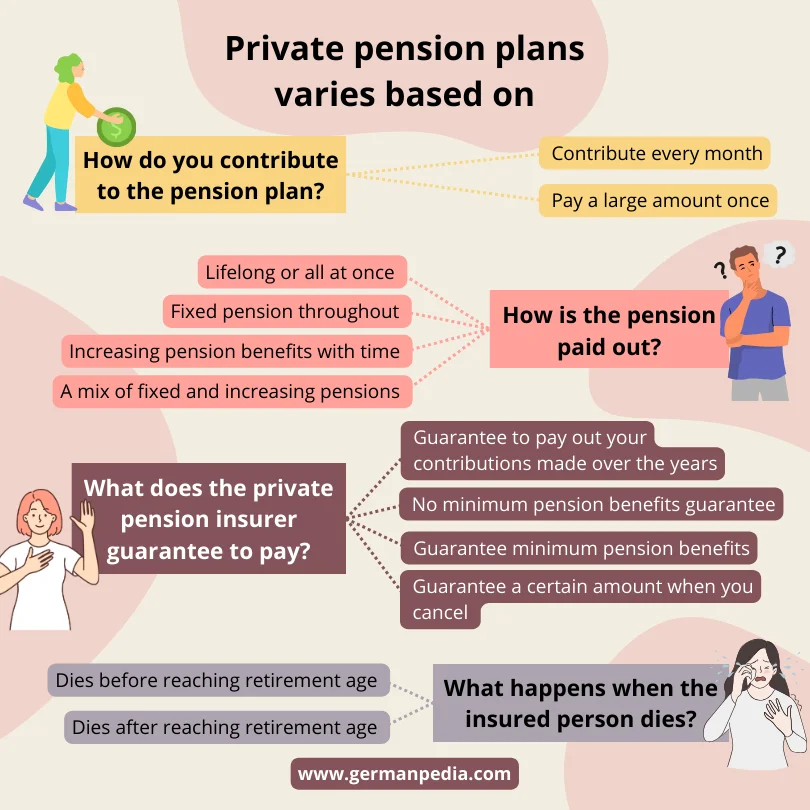

There are several variations of private pension plans in Germany. The variations come from answering the following questions.

- How do you contribute to the pension plan?

- How is the pension paid out?

- What does the private pension insurer guarantee to pay?

- What happens when the insured person dies?

How do you contribute to the pension plan?

Contribute every month (Deferred Pension Plan (Aufgeschobene Rente)): You pay a monthly pension premium till you retire. After retirement, the pension insurance company pays the saved capital as a monthly pension.

Pay a large amount once (Immediate Pension Plan (Sofortrente)): You pay a large sum once (a one-time contribution) to the private pension provider. And the private pension insurer starts paying back the capital as monthly pensions immediately. You also have the option to postpone the start of your monthly pension for a few years.

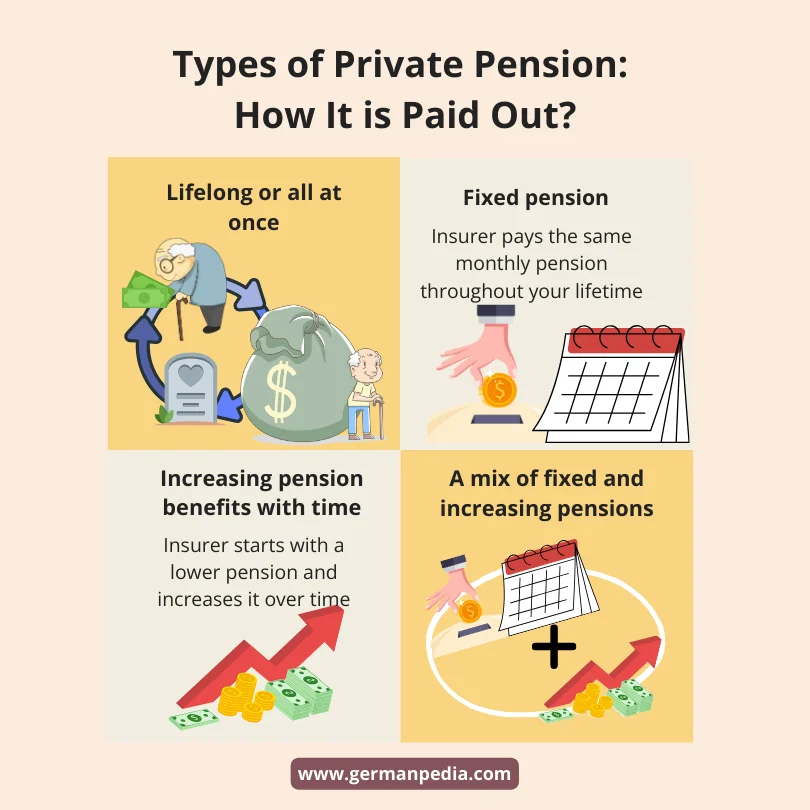

How is the pension paid out?

Lifelong or all at once: You can decide whether you want to get a monthly pension after retirement or the entire capital as a lump sum in one go.

NOTE: Monthly pensions are more tax-efficient than a one-off payment.

Fixed pension throughout: In a fixed or constant pension plan, the insurer pays the same monthly pension throughout your lifetime. The private insurance company forecasts the capital gains for the entire retirement period and includes it while calculating the pension amount.

The private pension provider reserves the right to reduce your pension if the capital gain assumption, in the beginning, falls short. Moreover, as your pension is fixed, your buying power reduces with time due to inflation.

Increasing pension benefits with time: In this case, the private pension company initially starts with a lower pension. But increases the monthly pension amount over time. However, the pension company can increase the amount only if the capital gains allow it.

Moreover, the insurer cannot reduce the pension amount in the future.

As the pension increases with time, the effect on your buying power is less due to inflation.

A mix of fixed and increasing pensions: In this type of private pension plan, part of the monthly pension increases with time and cannot be reduced. The insurance company calculates the other part before the start of retirement, and it can be reduced.

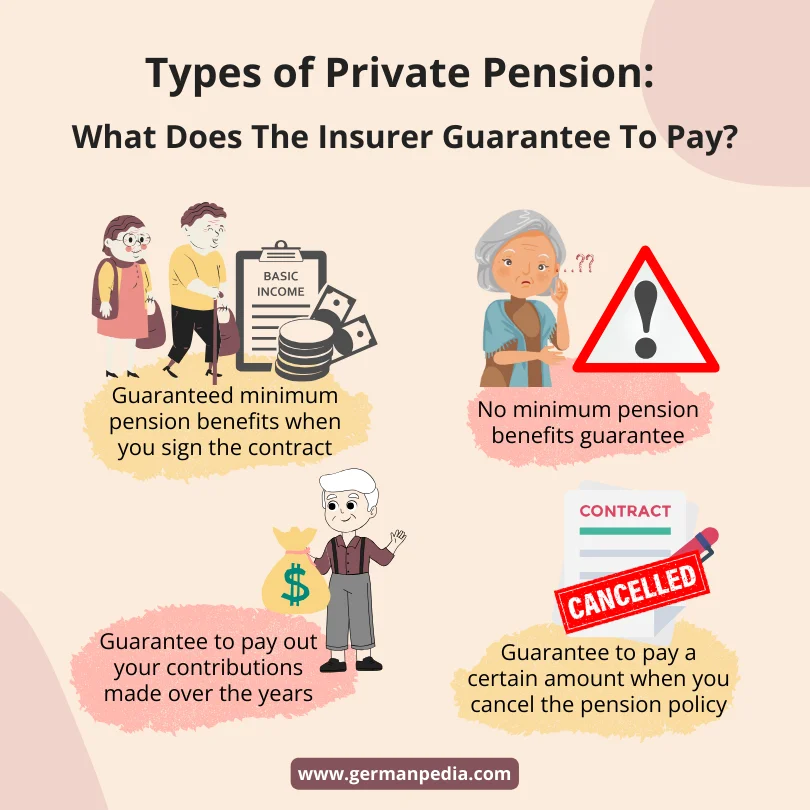

What does the private pension insurer guarantee to pay?

Guarantee minimum pension benefits: The private pension company calculates the minimum pension from the guaranteed capital and fixes it when you sign the contract.

Guaranteed capital is the sum that private pension providers usually invest in low-risk investments. In short, it’s the amount the insurer guarantees you’ll get back during your retirement.

But the total pension amount also consists of a portion coming from non-guaranteed capital. The insurer determines the pension from non-guaranteed capital at the beginning of the pension payment.

Non-guaranteed capital is the sum that an insurer invests in high-risk investments. Thus, the insurer cannot guarantee whether you’ll get it back during retirement.

So, it’s a risk that private pension policyholders must bear.

No minimum pension benefits guarantee: Private pension providers who do not have a guaranteed capital do not offer a minimum pension benefits guarantee.

Still, the insurers mention a pension amount when you sign the contract. However, they can change it during the saving phase.

The private pension insurers fix the pension amount only at the start of retirement.

Guarantee to pay out your contributions made over the years: Some private pension policies guarantee to pay out your entire contributions. Other insurers require a minimum term before the guarantee kicks in. But some pension providers don’t offer such a guarantee.

No pension insurance provider guarantees the payout of interests earned over the years. Moreover, the value of the pension policy that invests all the capital in high-risk investments can sometimes turn negative. And as a policyholder, you bear the risk.

Guarantee to pay a certain amount when you cancel the pension policy: Most private pension policies mention the amount you’ll get when you cancel the policy. It is called surrender value (Rückkaufswert in German).

Always check the surrender value before signing the private pension contract. Moreover, you can sell or lend your pension plan instead of canceling it.

What happens when the insured person dies?

Dies before reaching retirement age: The private pension provider pays the surviving beneficiaries at least the paid contributions or an agreed death benefit. Hence, it’s crucial that you name a beneficiary or nominee in the pension contract.

Dies after reaching retirement age: In the event of your death during retirement, the pension insurance company distributes the remaining capital among other policyholders. Your relatives will get the pension benefits only if you agree so in the pension contract. For example, in the event of your death, the pension company must pay the remaining capital to your relatives or make pension payments for a certain period, etc.

What are the risks of taking a private pension in Germany?

Private pension plans in Germany come with the following risks.

- You won’t get the amount contributed to the pension insurance back within your lifetime

- You risk losing your pension

- You’ll be unable to access your own money

You won’t get the amount contributed to the pension insurance back within your lifetime

Private pension companies in Germany use the “Pension Factor (Rentenfaktor in German)” to determine the monthly pension after retirement.

For example, as per your pension contract, the total capital you’ll accumulate before retirement is 200k €. So, you’ll get a monthly pension of 600 € with a pension factor of 30 and 400 € with a pension factor of 20.

Hence, to receive the entire amount you paid (insurance premiums), you must live till you are 94.8 years old with a pension factor of 30 and 108.7 years with a pension factor of 20.

Thus, check carefully how much pension you’ll get and whether it’s worth it.

We think it’s better to take matters into your hands and invest in broad-market ETFs.

Risk of losing your pension

Many private pension policies invest your contributions in high-risk investments. Of course, it offers the prospects of a higher return. But it comes at a higher risk at the same time.

As a policyholder, you bear the capital market risks. Hence, if the investments didn’t perform as expected, you might lose your pension also.

Thus, it’s better to invest yourself instead of paying pension insurance companies fees to manage your pension funds.

Unable to access your own money

You cannot cancel your pension insurance once you start receiving a pension. It means you can no longer get the entire capital as a lump sum.

In other words, you lose the flexibility and freedom to use your money however you wish.

Are there any tax advantages for taking a private pension plan in Germany?

Unlike Riester, Rürup, and Company pension plans, you don’t get any significant tax advantages for taking a private pension plan in Germany.

You pay the pension premiums from your net income instead of gross. Hence, you have already paid the income tax.

The only tax advantage is the income from your dividend, and interest is tax-free. However, the pension insurance fees, low returns, and inflexibility offset that benefit.

Thus, taking a private pension plan to save tax isn’t worthwhile.

Alternatives to private pension plans in Germany

Rely on yourself to invest your hard-earned money instead of an insurance company. With that said, here are the two simple options to secure your old self.

ETF savings plan

You can invest in cheap MSCI World ETFs that comprise big conglomerates from all around the world. By investing in ETFs yourself, you have full control of your investments.

You can do whatever and whenever you want with your investment without worrying about penalties or fees.

You can open a free ETF savings plan with Scalable Capital*. The savings plan automatically invests an amount of your choice in a particular ETF you selected every month. Thus building your retirement cushion.

Scalable Capital

- Free savings plans for all ETFs

- Invest from 1 euro savings amount

- Flexible execution dates and frequencies

Invest in Real estate

Another great way to secure your pension is by investing in real estate. You buy or rent your own house; both offer safety in old age.

You live rent-free in old age if you live in your house. Similarly, if you rent your house, you’ll get a monthly rent that can supplement your existing state pension.

You can learn more about buying a house in Germany in our guide.

Expats guide to buying a house in Germany

- The process of buying a house in Germany.

- How do you evaluate a property in Germany?

- What documents should you check before buying a house in Germany?

- How do you get a mortgage from a German bank?

- Tips and tricks to save thousands of euros.

- Average renovation costs in Germany and more…

Can I cancel my private pension insurance in Germany?

Yes, you can cancel your private pension plan if you haven’t received any pension yet. But in most cases, it’s not beneficial to cancel your private pension scheme for the following reasons.

- Most of your monthly pension contributions in the first five years cover the insurer’s fees. And the insurance companies don’t return the fees paid by you.

- It’s not beneficial to cancel old pension insurance policies that offer a high guaranteed interest rate, which is rare nowadays.

What are the alternatives to canceling private pension insurance in Germany?

Instead of canceling the private pension plan, you can do two things.

- Sell your private pension plan: Usually, by selling your pension plan, you get a better amount than canceling it. You can sell your pension plan to Winniger.de. They are the only company in Germany as of July 2023 that buys private pension plans.

- Lend your private pension plan to raise money: Many companies offer loans against private pension plans. But you should check with your insurer first if they offer a loan and on what terms. Next, you can check with other lenders for comparison. The loan against your pension policy is different from a normal loan. In this, you only pay interest over the loan term. And you repay the entire loan amount at once at the end.

How to find a good private pension plan in Germany?

Although we believe investing in ETFs and real estate offers better returns and flexibility. But if you think private pension insurance is a better option for you, you can compare different private pension plans on Check24*.

You can also get a free consultation from financial or insurance advisors.

We recommend contacting independent advisors who get paid by you instead of the insurance companies.

It ensures that they offer unbiased advice, keeping your best interests in mind.

References

- https://www.bafin.de/EN/Verbraucher/Versicherung/Produkte/Rentenversicherung/renten_node_en.html

- https://www.deutsche-rentenversicherung.de/DRV/DE/Rente/Moeglichkeiten-der-Altersvorsorge/Drei-Saeulen-der-AV/DS-Die-drei-Saeulen-der-Altersvorsorge.html

- https://www.destatis.de/EN/Themes/Labour/Labour-Market/Quality-Employment/Dimension4/4_7_StatutorPensionInsurance.html