Key Takeaways

- Legal protection insurance covers the legal expenses incurred in disputes in the insured areas of law.

- There are four major types of legal insurance in Germany – private life, work, residential housing, and traffic legal protection insurance.

- Legal insurance policy may cost from 70€ to more than 400€ per annum depending on your personal situation and the legal services you choose.

- There are several cheaper alternatives to legal expenses insurance.

- Legal insurance is not an all-around carefree package. In principle, you cannot insure many areas of law.

- Legal insurance providers don’t cover the legal conflict that existed before the conclusion of the contract or during the waiting period.

- You must take personal liability insurance and disability insurance before taking legal protection insurance.

This is how you do it

- Explore the cheaper alternatives of legal insurance in Germany.

- If the alternatives of legal insurance don’t fulfill your requirements, check whether legal protection insurance offers you the protection you seek.

- If yes, you can compare the legal insurance offers on Check24* or Verivox*. If you want a service in English, check legal insurance from Feather* and Getsafe*.

- Check the insurance policy details to see whether the tariffs cover your desired legal services.

Table of Contents

About half of the households in Germany have legal insurance. They believe that with the help of legal protection insurance, they can assert their rights.

But is legal insurance really helpful?

In this guide, we’ll explore the key aspects of legal insurance in Germany, including its benefits, and how to choose a policy that fits your needs.

We’ll also look into cheaper alternatives to legal protection insurance in Germany to cover your legal expenses.

What Is Legal Insurance?

Legal insurance (Rechtsschutzversicherung in German) covers the legal expenses derived from a legal dispute.

Is legal insurance worth it?

How sensible it is for you to take out legal insurance depends primarily on your circumstances.

Firstly, ensure that you have insurances that are more important than legal insurance, such as personal liability and disability insurance.

If you do not have liability insurance and seriously injure someone else or cannot work due to illness, it can be much more expensive than a legal dispute.

If you find yourself in a legal situation, you’ll need a few hundred euros for a lawyer. Later, maybe a few thousand euros if the legal case ends up in court.

Of course, that’s a lot of money.

But before you take out legal insurance, you should consider

- How often do you get into legal disputes

- And how much you have paid for the insurance over the years.

The probability of being involved in a court case is statistically very low.

In addition, a legal insurance policy is relatively expensive.

Depending on the scope of the insurance policy, the legal insurance cost can be several hundred euros a year. Moreover, there are cheaper alternatives for some legal questions and problems.

In short,

- first, take important liability insurance policies

- Then check how often you expect to get into legal disputes

- Lastly, how much will the legal dispute cost you?

You can compare insurance companies and their tariffs on Check24* or Verivox*.

If you are looking for English customer service, you can check legal insurance from Feather* and Getsafe*.

We’ll also see later in the guide for whom taking a legal insurance contract makes sense.

Ten legal insurance alternatives in Germany

- Sometimes free legal advice helps to assess the legal costs and prospects of a legal dispute. You can decide on moving forward with the dispute based on the legal expenses.

- Pay for an initial consultation with a lawyer or an exchange of legal letters. Many disputes can be settled in this pre-court area.

- Tenant associations (Mieterverein in German) can answer all your questions regarding tenancy law in Germany.

- The membership fee is 50 to 100 € per annum (depending on the city). It’s way cheaper than taking home rental legal insurance.

- As a member, you receive free advice on problems with the rental property.

- Moreover, you receive support immediately after joining the association. Normally, there is a waiting period of three months for legal protection insurance.

- Similarly, Landowners’ associations (Vermieterverein in German) provide free legal advice to property owners.

- As a trade union member, you can use their legal services if there is a dispute with the employer or problems with social security.

- Your private liability insurance defends you in court in case of claims for damages against you. Even if there is a lawsuit, you don’t have to pay anything for it.

- Your car insurance covers the disputes against you as a driver. Initial legal advice on traffic law is often also given to members of automobile clubs like ADAC. Hence, you do not necessarily need traffic legal insurance in Germany.

- The insurance ombudsman (Versicherungsombudsmann in German) can support you if you have a dispute with your insurance company. The insurance ombudsman tries to settle the dispute out of court. Hence saving you court fees. On top of that, it doesn’t charge you any legal fees.

- You can apply for legal aid for legal disputes (Prozesskostenhilfe in German) in certain circumstances.

- Advisory service (Beratungshilfe in German) – They support you in out-of-court disputes and legal advice if you are short on money. You can obtain a counseling aid certificate (Beratungshilfeschein in German) from the local district court responsible for your place of residence.

For whom legal insurance makes sense

Take legal insurance based on your personal situation

Whether and what type of legal insurance you’ll need depends on your personal situation.

For example, traffic and employment legal insurance is worth it for someone who commutes to work by car daily and fears trouble at work.

On the other hand, a pensioner without a car does not need any protection in these areas. Thus, assess your personal situation and accordingly consider taking legal insurance.

You can compare insurance companies and their tariffs on Check24* or Verivox*.

If you are looking for English customer service, you can check legal insurance from Feather* and Getsafe*.

Feather Legal Insurance

- Legal insurance policy starting from €13.51 per month

- Free legal consultation

- English customer support

- Cancel the insurance policy monthly

Getsafe Legal Insurance

- Free legal consultation

- English customer support

- Cancel the insurance policy monthly

Compare Legal Insurance on Tarifcheck

- Compare offers from different insurance companies

- Find the policy that fits your needs

- Check customer reviews

Compare Legal Insurance on Verivox

- Compare offers from different insurance companies

- Find the policy that fits your needs

- Check customer reviews

Probability of legal disputes

What is the risk that you’ll get into a legal dispute in the foreseeable future?

- Do you tend to push the speed limit, or do you always stay within limits?

- Is your workplace safe and your employer friendly?

- Do you have a good relationship with your neighbors?

- Do you think you can resolve disagreements without taking legal action?

The less likely it is that you need a lawyer or even have to go to court, the less you need legal protection insurance.

But if you want to be covered independently of these considerations, you should take out private legal insurance.

Private legal insurance protects you against high legal expenses. Thus, you can assert your rights against financially strong opponents such as large companies.

Pay close attention to the small print when purchasing legal insurance to avoid any surprises at the time of claims.

We recommend you compare different legal insurance companies and their tariffs before buying.

4 types of legal insurance in Germany

There are four common legal insurance types in Germany.

- Private life legal insurance (Privat-Rechtsschutz)

- Work legal insurance (Berufs-Rechtsschutz)

- Transport legal insurance (Verkehrs-Rechtsschutz)

- Real estate legal insurance (Wohn-Rechtsschutz)

The advantage of dividing legal insurance into different categories is you pay for the services you need. Thus, assess the areas important to you and take the legal insurance policies accordingly.

The table below shows the five most claimed categories in legal protection.

| Damage Category | Description | Percentage of customers who filed the claim |

|---|---|---|

| Contracts | Purchase contracts, rental contracts, travel contracts | 17% |

| Traffic | Fines, driving license withdrawal, hit and run, dangerous bodily harm | 15% |

| Damages | Damages and compensation for pain and suffering, accidents, dog bites, medical treatment errors | 10% |

| Work | Warning, dismissal, false testimony | 10% |

| Residential | Neighborhood disputes, rent increases, utility bills | 9% |

Source: Finanztip

#1 Private legal insurance Germany (Privatrechtsschutzversicherung)

Private legal insurance covers the following areas of your everyday life.

- Contracts – Covers you for legal disputes about travel, purchase, service, and insurance contracts. For example, if a craftsman messes up, or you demand money back because of travel issues.

- Compensation – Supports you in claiming damages, such as after a car, bicycle, or foot accident.

- Tax – Legal dispute with the tax office. For example, legal disputes about the recognition of special expenses, income-related expenses, or extraordinary burdens.

- Social – Legal insurance also covers the costs of legal disputes with German social services. For example, issues with your health insurance company, getting recognition for an occupational disease, etc.

- Traffic and Driving – Trouble related to traffic and driving authorities. For example, your driver’s license was revoked, and now the authorities refuse to enact it.

- Inheritance and family – Advice on adoption, child support, custody, or inheritance. Usually, legal insurance providers exclude this area. So, ensure that your insurance policy includes it if it’s important to you.

- Criminal law – The insurance cover applies to traffic, administrative, and negligent offenses. However, if the authorities accuse you of committing the crime intentionally, your legal insurance might not cover the legal costs. But if you are acquitted, the insurance company will reimburse the legal expenses.

Supplementary modules to cover legal costs

- Extended criminal legal protection – It covers you for the criminal cases in which authorities accuse you of intentionally committing an offense. However, you must pay back the legal expenses if found guilty.

- Extended legal protection for the Internet – As the name suggests, this covers you in case you are a victim of cyber crimes. Many legal insurance policies offer this as an add-on.

#2 Work legal insurance Germany (Berufsrechtsschutz)

As we saw earlier, private legal insurance doesn’t include legal issues relating to your job. For this, you need professional legal insurance.

Unfortunately, no insurance provider offers professional legal insurance individually. Hence, you need to combine it with other types of legal insurance.

Normally, people buy work legal insurance as an additional module to their private legal insurance.

There is special work legal protection insurance for the self-employed.

Here are some common situations where professional legal protection insurance can support you.

- Your wages are not paid

- You do not get any vacation

- You get a bad job reference

- Disputes about a warning, termination, or severance pay

#3 Residential legal insurance Germany (Wohnrechtsschutzversicherung)

Home legal protection insurance can be purchased by both tenants and landlords. Of course, the coverage is different.

The tenant’s home legal insurance covers the following legal conflicts.

- Dispute over a rent increase

- Billing of ancillary costs

- Rental contract terminations due to personal use and eviction

- Dispute between neighbors.

The landlord’s home legal protection insurance covers the following conflicts.

- Rent increase

- Rent reductions or defaults

- Utility costs (Nebenkosten in German)

- Move out and security deposit

- Termination of rental contract due to your (landlord’s) personal needs

- Disputes with the authorities, e.g., waste disposal fees

- Credit checks on a potential tenant can also be insured

Like work legal insurance, you cannot buy residential legal insurance individually.

In most cases, private legal insurance is the base on which you can add other types of legal insurance. But there are insurance providers who offer other insurance policy combinations.

For example, ADAC offers traffic legal insurance as the base on which you can add other types of legal insurance.

#4 Traffic legal insurance Germany (Verkehrsrechtsschutz)

You can take out the traffic legal protection module individually or together with private legal insurance.

What does traffic legal insurance cover?

- The insurance covers you and all the passengers.

- The insurance also covers you if you are driving someone else’s vehicle, e.g., a rental car or e-scooter.

- The insurance also helps in the event of a legal dispute after buying a car or after an accident if you were a pedestrian or cyclist.

- Some insurers even offer coverage for all “modes of transport.”

The insurance company pays the following legal bills if a dispute ends up in court.

- Lawyer fees (your’s and opposing)

- Court fees

- Costs of an expert.

What does traffic legal protection insurance doesn’t cover?

- Defense against claims for damages. Your car insurance usually covers it.

- Intentional crimes, e.g., illegal car racing, coercion through tailgating, or drunk driving.

Who is insured in legal protection insurance?

You can take out private legal protection insurance for

- you only,

- you and your partner,

- or you can choose family legal protection. This insurance policy covers adults and unmarried children. The insurance covers the children if they no longer live at home. But only until they get a job.

Many tariffs include other family members living in the household. For example, if your parents or parents-in-law live with you in the same household, you should consider taking a plan that covers them also.

What legal costs does legal insurance cover in Germany?

The legal insurance covers the following legal fees depending on your contract.

- court costs,

- witness expenses

- experts’ fees,

- costs of the litigant if you lose in court,

- legal costs incurred abroad (e.g., translation and travel costs),

- an interest-free loan for bail if required,

- lawyer fees if the case ends up in court,

- lawyer fees for out-of-court work,

- mediation costs – either in full or up to a maximum amount, depending on your tariff. The costs are usually between 3,000 and 6,000 euros per claim or year,

- getting legal advice over the phone. Many insurers offer a 24/7 hotline to get legal advice over the phone. You can even ask questions about areas your insurance policy doesn’t cover.

Note: You must inform your insurance company before entering into a legal dispute. Only with the confirmation of coverage can you be sure that your insurance company will pay.

Good to know that your legal insurance provider does not pay your fines.

Approximate litigation costs in Germany in different scenarios

Court costs in Germany depend on the amount in dispute. The amount in dispute is the maximum claim the winning party may get.

| Legal Cases | Amount in dispute (in euros) | Court costs(in euros) |

|---|---|---|

| Rent reduction due to mold | 4693 | 2259 |

| Landlord evicting you from the rental property for their personal use | 8940 | 3671 |

| Unfair job dismissal and bad job reference | 12300 | 4380 |

| Travel deficiencies on vacation | 2700 | 1554 |

| Revocation of a purchase contract for a defective new car | 37000 | 7405 |

Source: [1]

Read our guide on how legal costs are calculated in Germany to learn more.

What does legal insurance not cover?

Having legal protection insurance doesn’t mean you have unlimited coverage. There are several restrictions and situations that legal insurance doesn’t cover.

- The insurer doesn’t cover the legal fees of conflicts that exist before concluding the contract.

- You often have three months or longer waiting periods before you can claim insurance benefits. But there are exceptions. For example, there is no waiting time in the event of a traffic accident.

The legal insurance in Germany does not pay the legal bills in the following cases.

- Someone sues you for the claims for damages you caused. In this case, you should have liability insurance.

- Disputes in the area of construction and construction financing of houses, apartments, etc. (e.g., “planning,” “construction or renovation of a property,” and “purchase or sale of a building plot”).

- Intentional crimes.

- Copyright, trademark, and patent law.

- Speculative capital investments, such as gaming and betting contracts.

- Legal trouble in connection with your self-employed or commercial activities. There is special legal insurance for commercial or self-employed people.

- Disputes between persons insured jointly in a family contract, such as spouses.

- Out-of-court disputes with the tax office or a social welfare office.

The cases excluded from the insurance coverage vary from one insurance provider to another.

In the past, vague terms and conditions in the legal insurance policy repeatedly led to problems between the insured and the insurance company.

For example, what does the insurer consider an uninsured capital investment transaction?

In the meantime, many legal insurance providers improved the description of their contract’s terms and conditions. They even explain the condition with concrete examples to avoid any confusion.

Thus, consider carefully which legal services are important to you before taking legal insurance. Check and understand the insurance terms and conditions carefully to avoid future conflicts.

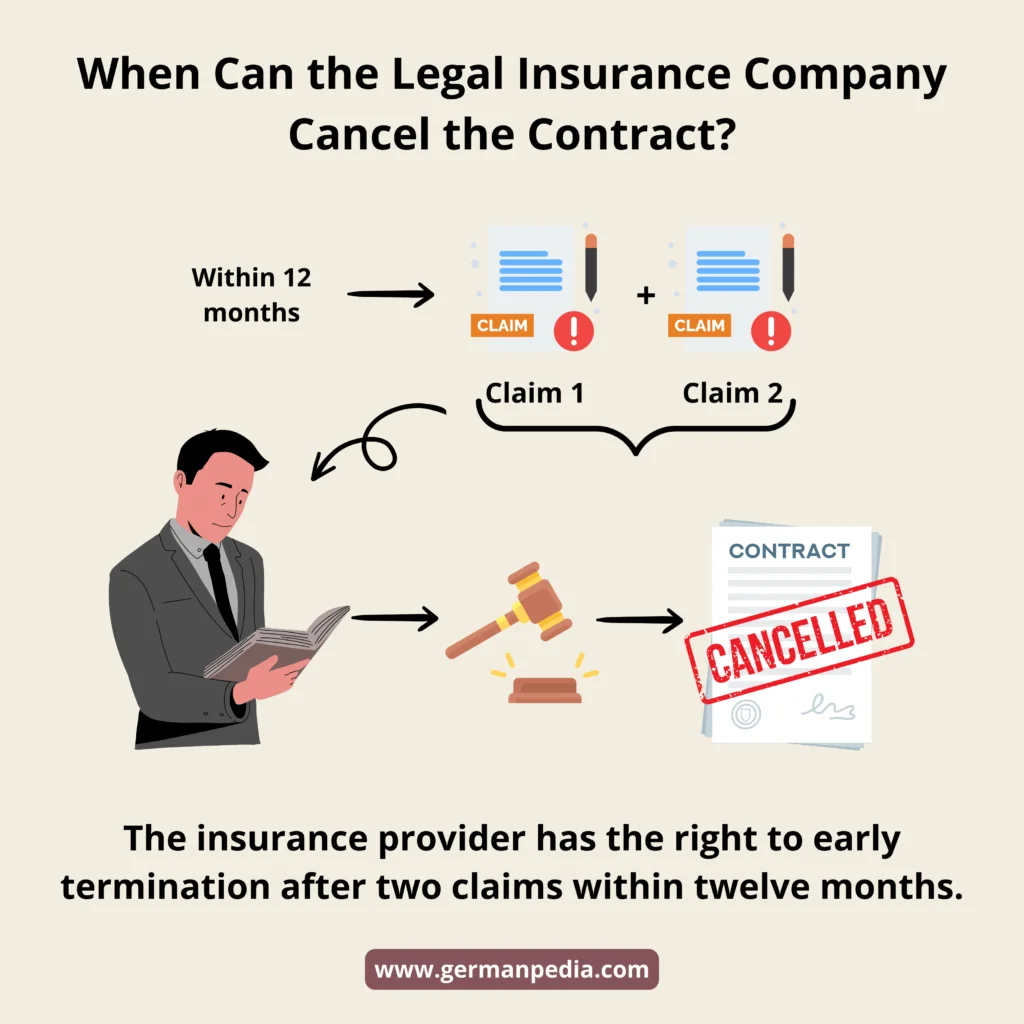

Cancellation of legal protection insurance in Germany

The insurance provider has the right to early termination after two claims within twelve months. However, legal advice over the phone should not count as a claim if the tariff is good.

Even if you rarely get into legal disputes, it can quickly lead to two claims.

For example, your employer gives you a termination notice. You want to defend yourself against this notice. But in the meantime, your employer issues you a bad job reference.

The German court considers the termination notice and bad job reference two separate legal cases. In this case, the insurance company has the special right to terminate the contract.

A contract cancellation from your insurer can make it difficult for you to find a new insurance provider.

When applying to the new provider, you must answer questions about previous insurance. You must provide information on the number of claims in the last five years and who terminated the previous legal insurance policy.

NOTE: You should never give false information as it can endanger your insurance cover.

TIP: If your insurance provider gives you a contract cancellation notice, you should ask the insurer to withdraw the notice so that you can terminate the contract yourself.

Free Legal Insurance Cancellation Letter

- Download the legal insurance cancellation letter.

- You can use the letter as it is. You only need to fill in your details.

- The letter is available in both docx and pdf formats. Hence making it easy to modify.

How to find the right legal insurance tariff?

Did you come to the conclusion that you need legal insurance? If yes, the next step for you is to find the right tariff.

Unfortunately, there is no single tariff that fits everyone. Hence, you must decide which legal services are important to you and choose the policy that provides them.

You can compare insurance companies and their tariffs on Check24* or Verivox*.

If you are looking for English customer service, you can check legal insurance from Feather* and Getsafe*.

NOTE: There are very few to no reviews regarding people’s experiences claiming legal insurance benefits from Feather. Hence, we cannot judge how good Feather’s service is after you sign the contract.

If you have made a legal claim with Feather in the past, please share your experience with us. It’ll help other expats in making an informed decision. You can send us your experience at contact[at]germanpedia.com

Feather Legal Insurance

- Legal insurance policy starting from €13.51 per month

- Free legal consultation

- English customer support

- Cancel the insurance policy monthly

Getsafe Legal Insurance

- Free legal consultation

- English customer support

- Cancel the insurance policy monthly

Compare Legal Insurance on Tarifcheck

- Compare offers from different insurance companies

- Find the policy that fits your needs

- Check customer reviews

Compare Legal Insurance on Verivox

- Compare offers from different insurance companies

- Find the policy that fits your needs

- Check customer reviews

Compare the benefits of the legal insurance tariffs

Once you have entered the data in the search, the comparison portal will show you the results. You shouldn’t jump and pick the first or cheapest tariff.

You must look at the tariff details to check the services the insurer provides. You can also select several legal tariffs and compare them with each other.

Ensure that the legal insurance offers the minimum features we believe a good legal insurance policy should cover.

We find it easy to check what legal services are present and missing on comparison portals like Check24.

Moreover, if a specific legal service is not included in the selected tariff, Check24 links to other tariffs that offer it.

NOTE: One comparison portal doesn’t list all the insurance providers. Hence, check different comparison portals to compare legal insurance tariffs in Germany.

Minimum legal costs your legal insurance should cover

There is no one best legal insurance in Germany. You must find the one that fits your needs.

Nevertheless, there are some criteria that a good legal insurance tariff should meet.

- Insured sum: The insured sum should be at least 5 million euros or, even better, unlimited. Many insurers offer this.

- Scope: Make sure that the legal protection also applies in other EU countries and worldwide for at least six months. The sum insured outside Germany is usually lower. But the risk of getting into an (expensive) legal dispute is also lower. Thus, an insurance sum of 300k € is sufficient. If you are traveling abroad for a longer period, this worldwide protection is not enough.

- Bail: Tariff should cover at least 100k €.

- Mediation: Good insurance policies also pay for out-of-court mediations. However, the insurer limits the maximum amount covered. Thus, check how much the insurance company pays per case or year for mediation. It should be at least 3,000 € per case or 6000 € per year.

- Telephone advice: It’s vital that you have the option to ask legal questions over the phone. Ideally, questions in any legal area. But at least for the areas you are insured. On top of it, it’s critical that the advice over the phone should not be considered a claim relevant to contract termination.

- Group of people: For family tariffs, check who is covered in the insurance policy.

- Deductible: Choose a deductible of around 150 € for traffic legal protection insurance and 250 to 300 € for others. Having a deductible reduces your yearly insurance contribution. No deductible should be due for legal advice over the phone.

NOTE: Since the insurance company can cancel the contract after two claims within twelve months, you should avoid reporting small cases.

| Criteria | Single | Family | Car Drivers |

|---|---|---|---|

| Total Insurance Sum | 5 million euros | 5 million euros | 500k euros |

| Insurance Sum Worldwide (Outside Germany) | 200k euros | 200k euros | 100k euros |

| Insurance Validity Period Outside Germany | at least 6 months | at least 6 months | at least 6 months |

| Bail amount | 100k euros | 100k euros | 100k euros |

| Deductible (Selbstbeteiligung) | 250 – 300 € | 250 – 300 € | 150 € |

| Extended Criminal Protection | Optional | Optional | – |

| Children insured | N.A. | Yes | Yes (N.A. for singles) |

| Partner insured | N.A. | Yes | Yes (N.A. for singles) |

| Mediation Costs | 3000 € per case or 6000 € per year | 3000 € per case or 6000 € per year | 3000 € per case or 6000 € per year |

| Telephone Consultation | Free consultation without contract termination | Free consultation without contract termination | Free consultation without contract termination |

Source: [1]

Other things to consider while taking legal insurance

The criteria below are not relevant to everyone, but they are worth mentioning. Consider whether they are important to you.

Consecutive Event Theory (Folgeereignistheorie in German)

How the insurance judges the beginning of the dispute can determine whether it pays for a dispute. For example, did the dispute begin when the actual damage occurred or began with the event that caused the damage?

Legal protection insurers in Germany do not cover the dispute costs that began before you took the insurance.

For example, A customer buys a bicycle and takes out legal insurance afterward. The customer had an accident a year later. The bike’s frame broke during the accident due to a material defect.

The legal insurance provider doesn’t cover the damage if the start of the legal dispute is not seen in the accident but in purchasing the defective bicycle.

But if you have taken the consecutive event theory (Folgeereignistheorie), the insurer covers the damage.

NOTE: An insurance policy with consecutive event theory clause can be expensive. So, if you don’t have very expensive items, the additional cost for the added protection might not be worthwhile.

However, more and more tariffs nowadays contain “consecutive event theory” protection. So, if it doesn’t cost much, you should add it to your insurance cover.

Extended criminal legal protection (Erweiterter Strafrechtsschutz in German)

Under this clause, legal insurance covers you even if you are accused of committing a crime intentionally. However, if you are found guilty, you must reimburse the insurer for the legal costs.

Extended criminal legal protection makes insurance expensive and reduces the number of tariff options. So you should avoid it if the insurance gets too expensive for you.

Moreover, if it turns out you were wrongly accused, the insurance company will pay the costs of the legal dispute afterward anyway.

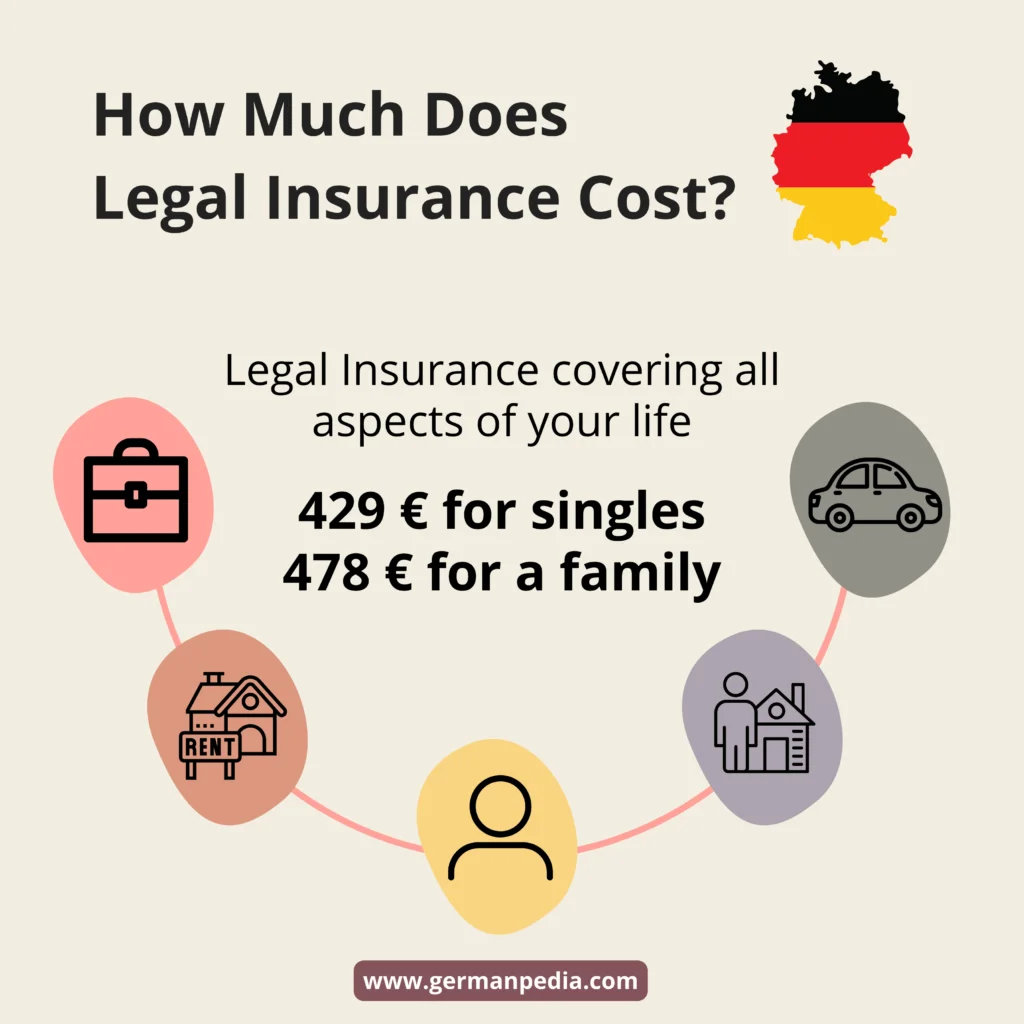

How much does legal insurance in Germany cost?

As you may guess, legal insurance costs depend on your personal situation, insurance plan, and the legal services you choose.

Here are the approximate costs of different types of legal insurance in Germany.

| Type of Legal Insurance | Average Cost per annum in euros (Single with 300 € deductible) | Average Cost per annum in euros (Family with 300 € deductible) |

|---|---|---|

| Private legal insurance | from 75 € | from 112 € |

| Private + Work legal insurance | from 158 € | from 186 € |

| Private + Transport legal insurance | from 122 € | from 155 € |

| Private + Rental home legal insurance | from 118 € | from 158 € |

| Real estate legal insurance for landlords | from 136 € | from 136 € |

| Legal insurance covering all aspects of your life (Private, work, transport, rental home, and landlord) | from 429 € | from 478 € |

NOTE: The insurance company assesses the risk of damage differently depending on where you live. Hence, legal insurance costs may vary depending on your place of residence.

You can deduct the legal insurance premium from taxes. You can read more about it in our guide.

What do you do if your legal insurance company doesn’t pay?

If your insurance company refuses to pay because it claims you caused the legal dispute willfully or that there is no chance of winning, you can appeal this decision.

You can appeal the insurer’s decision via an arbitrator’s report (Schiedsgutachten) or a casting vote (Stichentscheid).

For the arbitration report, an expert commissioned by you will assess the case, and your lawyer will explain the chances of success for the final decision.

The result of both procedures is binding for the insurer.

In the event of a dispute with your insurance provider, you can also contact an insurance ombudsman.

The insurance ombudsman examines the case free of charge and can oblige the insurance company to finance a lawsuit if it would not cost more than 10,000 €.