Key takeaways

- Traffic legal insurance covers the legal expenses of disputes related to road traffic.

- The mode of transport doesn’t matter. Traffic legal insurance covers you as a cyclist, pedestrian, driver, etc.

- You can get a traffic legal protection insurance tariff without a waiting period.

- You should get traffic legal insurance if you travel often by car or long distances.

- Car insurance doesn’t cover the legal costs if you want to claim damages and compensation. You need traffic legal insurance for it.

This is how you do it

- You can compare the legal insurance offers on Check24* or Verivox*. If you want a service in English, check Getsafe* legal insurance and Feather*.

- You should get a policy that insures at least 500,000 €.

- If you plan to travel abroad and drive a car, ensure your traffic legal insurance offers worldwide coverage.

Table of Contents

What is traffic legal protection insurance in Germany?

Traffic legal insurance is a type of legal protection insurance. It covers the legal costs of disputes related to road traffic.

Here are some examples of where traffic legal insurance can help.

- You met with an accident, and there is a dispute about who is responsible for it.

- Disputes after purchasing a car

- Object against a fine

The mode of transportation doesn’t matter for claiming traffic legal insurance services. You can travel by car, bicycle, e-bike, bus, or as a pedestrian.

If you end up in a legal dispute related to mobility, traffic legal insurance will cover the lawyer’s fees and court costs.

Is traffic legal protection insurance worth it?

Traffic legal insurance is recommended for the following people.

- People who travel daily in their own car or their company’s car.

- People travel long distances often.

- Cyclists roam around the city on bikes daily.

- People who like to run daily, irrespective of the weather outside.

Car owners may ask why they need traffic legal insurance when they already have a car insurance policy. To understand, let’s check what your car insurance covers and what it doesn’t.

Your car insurance provider covers the legal costs and damages if the accident is your fault. The insurer will also defend you in court against the other party’s damage claims.

However, the car insurance company doesn’t cover the legal costs in the following situations.

- YOU want to claim damages.

- Dispute regarding who is at fault for the accident.

You need a traffic legal insurance plan to cover the legal costs and assert your rights in these scenarios.

Moreover, a lawyer’s fee and court costs can quickly add up to thousands of euros. Yes, if you win the case, you’ll get the money back. But you must still pay the money upfront until the case is concluded.

Like any other country, courts in Germany take their sweet time to resolve a dispute. Hence, it’s beneficial to have legal insurance in Germany.

What is insured under traffic legal insurance in Germany?

Traffic legal protection insurance covers the legal costs of disputes in the following legal areas.

- Damages law (Schadensersatzrecht): You met with an accident. You want to pursue a legal case to claim the damages or compensation for the pain. Legal insurance covers the legal costs.

- Criminal law (Strafrecht): The insurer covers the cost of your defense if you are suspected of criminal activity. For example, hit and run, insulting other road users, negligent bodily harm, etc.

- Contract and property law (Vertrags- und Sachenrecht): Dispute regarding buying a car, car purchase contract, car loan, etc.

- Tax law (Steuerrecht): Legal disputes with the tax office (Finanzamt) over vehicle tax.

- Administrative law (Verwaltungsrecht): Disputes with the government authorities, such as driver’s license suspension.

Who is insured in the traffic legal insurance contract?

You and your family are insured under traffic legal insurance. Even the car passengers are insured.

What is NOT insured under traffic legal insurance in Germany?

- Normally, traffic legal insurance doesn’t cover disputes regarding illegal parking or over-speeding. But you can find tariffs that do cover it. But if you claim disputes for illegal parking too often, the insurer will cancel your policy.

- You were in an accident, and the other party claimed damages and compensation for pain. In this situation, your car insurance will cover the legal costs instead of traffic legal insurance.

- You caused an accident while walking or cycling, and the other party claims damages. Your personal liability insurance covers the legal costs in this case.

- You use your vehicle for self-employment or freelance work and find yourself in a legal dispute. Traffic legal insurance won’t cover the legal expenses.

- You caused damage intentionally, such as damage caused by taking part in illegal car racing or driving while you were drunk. Legal insurance will not cover the legal costs.

You can get an insurance policy with extended criminal law. In this case, the legal insurance provider will cover the legal costs if you are suspected of a crime. But you have to return the money if found guilty.

Sample scenarios where traffic legal protection insurance covers you

Traffic legal protection supports you by covering the lawyer’s and court’s fees in the following cases.

- You buy a new vehicle that has serious defects. You want to return it, which leads to a legal dispute with the car dealership.

- You are jogging in the forest, and a cyclist collides with you. You need support to assert your rights and claim damages.

- You had an accident abroad. The other party claims damages against you. Here, the dispute will be resolved in the foreign court. You need not only a lawyer but also an interpreter. Sometimes, you also need a deposit to stay out of jail. Traffic legal insurance covers the costs.

- Your car was in the workshop for repairs, but the defects weren’t completely fixed. However, the workshop still demands the full invoice amount, which leads to a legal dispute.

What services does the best traffic legal insurance offer?

- Insured sum (Versicherungssumme): This is the maximum amount that the legal insurance company will pay in legal costs. The higher the insured sum your policy offers, the better. Deutschen Versicherungswirtschaft (GDV) recommends 500k € as the minimum insured sum.

- Criminal prosecution abroad: Your insurance should cover at least 100,000 €. If you don’t drive outside Germany, this is not relevant to you.

- Worldwide protection (Weltweiter Schutz): Usually, traffic legal insurance coverage is valid in other European countries. However, you can also get a policy that offers worldwide coverage. So, if you plan to travel abroad and drive a car, consider having it in your contract.

- Free legal advice on the phone. It’s a very important feature of legal protection insurance. This clause allows you to clarify doubts on the phone for free. And it doesn’t count as a claim valid for contract termination.

- No waiting period: Legal protection insurance provider doesn’t cover the legal costs of disputes arising during the waiting period. However, you can find a traffic legal insurance policy without a waiting period. So, if you find yourself in a legal dispute, get traffic legal insurance to cover the costs.

- Family member coverage: Comprehensive legal insurance covers all your family members, including children. Adult children who live in the same household are also covered. Adult children who don’t live in the same household are also covered. But they should be studying and unmarried.

How do you find a good traffic legal insurance plan in Germany?

Which traffic legal insurance fits you depends on your requirements. Singles can get a tariff that covers only them. However, if you have a family, you need an insurance policy that covers all your family members.

You should compare the services offered by different legal protection insurance providers and pick the one that offers the best price performance.

You can compare the legal insurance offers on Check24* or Verivox*. If you want a service in English, check Getsafe* legal insurance and Feather*.

Feather Legal Insurance

- Legal insurance policy starting from €13.51 per month

- Free legal consultation

- English customer support

- Cancel the insurance policy monthly

Getsafe Legal Insurance

- Free legal consultation

- English customer support

- Cancel the insurance policy monthly

Compare Legal Insurance on Tarifcheck

- Compare offers from different insurance companies

- Find the policy that fits your needs

- Check customer reviews

Compare Legal Insurance on Verivox

- Compare offers from different insurance companies

- Find the policy that fits your needs

- Check customer reviews

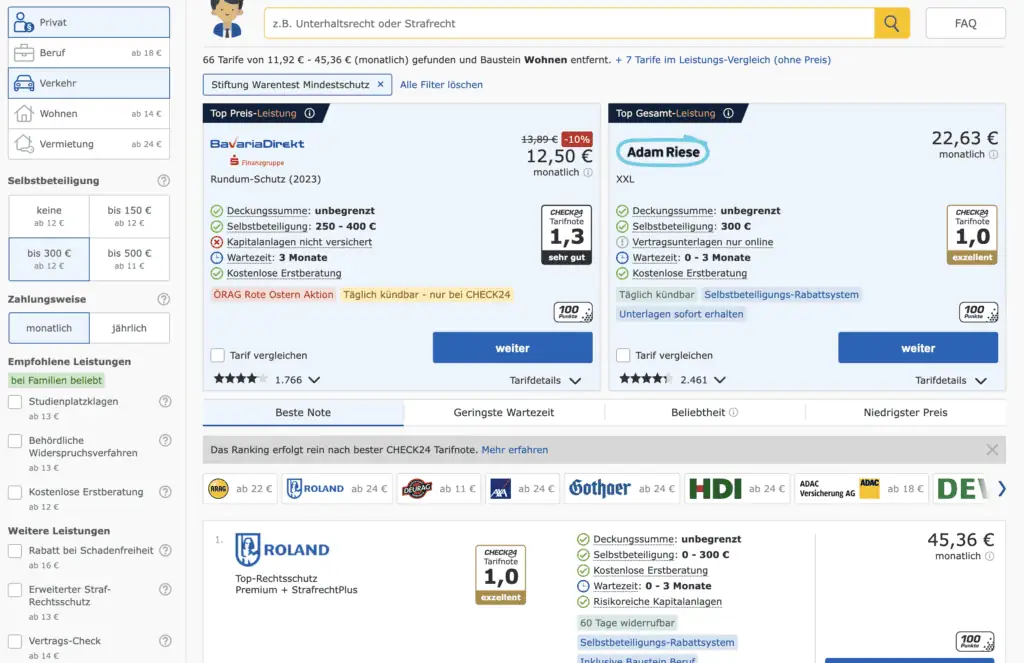

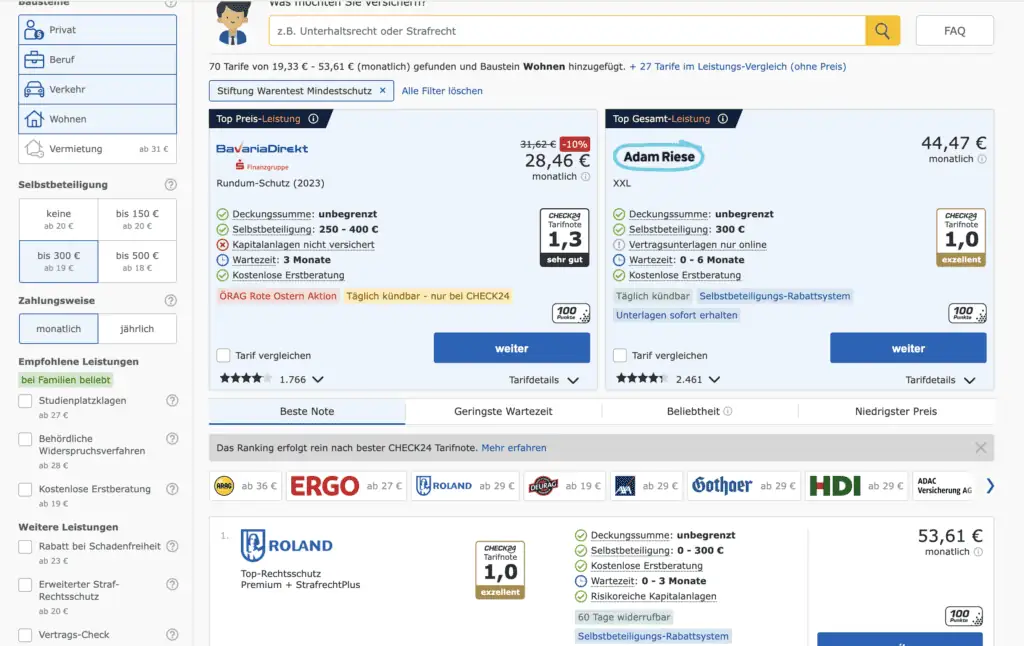

How much does traffic legal protection insurance cost?

Traffic legal insurance costs depend on the following factors.

- Are you single or have a family?

- How much is the deductible amount?

- What services do you opt for?

- How much is the insured sum?

- Other types of legal insurance you took together with traffic legal insurance.

On average, a good traffic legal insurance tariff for families costs between 9 € and 23 € per month. If you add other types of legal insurance, it’ll cost between 30 € and 60 € per month.

FAQ

Does traffic legal protection insurance have a waiting period?

No, traffic legal insurance doesn’t have a waiting period. However, other types of legal insurance have a waiting period.

For example, tenant’s and landlord’s legal insurance have a three-month waiting period.

The Legal insurance company doesn’t cover the legal costs of the dispute arising during the waiting period.

Can you choose your own lawyer?

Yes, you can choose your own lawyer if your contract has the “Right to choose a lawyer (Freie Anwaltswahl)” clause. Usually, every legal protection insurance has this clause.

Can a traffic legal insurance provider cancel your contract?

If you claim the legal costs for two cases, the traffic legal insurance company can terminate your contract.

You can learn more about it in our guide on canceling legal protection insurance.

References

- https://www.finanztip.de/rechtsschutzversicherung/verkehrsrechtsschutz/

- https://www.huk.de/haus-haftung-recht/rechtsschutzversicherung/verkehrsrechtsschutz.html

- https://www.allianz.de/recht-und-eigentum/verkehrsrechtsschutzversicherung/

- https://www.ergo.de/de/Produkte/Rechtsschutzversicherung/Verkehrsrechtsschutz

- https://www.adac.de/produkte/versicherungen/rechtsschutzversicherung/verkehr/