Understand the mortgage process in Germany. Explore key insights into securing a home loan, working with mortgage brokers, understanding mortgage interest rates, and negotiating mortgage contracts with banks in Germany. Learn insider tips on buying a house in Germany and finding the best mortgage offer.

Key takeaways

- You need a valid visa in Germany to get a mortgage from a German Bank.

- A low interest rate or borrowing rate is not always the best offer. Therefore, it is essential to understand how your bank calculates the interest rate before signing the mortgage contract.

- Real estate investors prefer low monthly installments.

- In Germany, you don’t have to repay the complete mortgage within the mortgage tenure. The borrower can refinance the remaining principal once the mortgage tenure ends.

This is how you do it

- The first step is to contact your home bank in Germany to enquire about the mortgage conditions.

- Contact different banks to explore various mortgage options.

- You can also contact mortgage brokers like Dr. Klein* and InterHyp* to find the right mortgage product.

- Negotiate the mortgage terms with the banks. Bidding banks against one another is the best way to negotiate a mortgage offer.

- Once you find the right home loan, sign the deal.

Table of contents

You found your dream house and want to get a mortgage against it. But you do not know how to apply for a mortgage in Germany.

Don’t worry! In this guide, you’ll learn how to apply for, get, and evaluate a mortgage offer in Germany.

We have also written a book for expats on how to buy a house in Germany. The book details each step of the home-buying process and tips that can save you thousands of euros. You can buy the book on Amazon*.

Process of getting a mortgage in Germany

Here are a few steps you have to follow to get a mortgage.

- Check if you qualify for a mortgage in Germany

- Find out the maximum mortgage you can get in Germany as an expat.

- Prepare the documents German banks need to issue a mortgage.

- Contact different banks and brokers to explore your mortgage options.

- Negotiate the mortgage terms with the banks.

- Finalize a bank and submit the required documents.

- Wait for the bank to create a draft of your mortgage contract.

- Check the mortgage contract draft. If everything looks good, sign the contract.

Let’s understand each step in detail.

Can expats get a loan in Germany?

Yes, you get a home loan in Germany as a foreigner. But you must fulfill the following requirements.

- You have a valid German resident permit. It’s tough for Blue Card holders to get good mortgage rates in Germany.

- You are living and working in Germany.

How do you determine the maximum mortgage you can get?

Knowing the maximum mortgage loan you are eligible for is critical. You can then find your dream house in Germany within that budget.

You can determine the maximum mortgage you can get in two ways.

- By contacting banks and brokers

- By calculating yourself

Contact your home bank to explore mortgage products

The home bank is where you have a salary account. Ask your bank consultant, “What is the maximum mortgage you can get to buy a property in Germany?”

The reasons for starting with the home bank are

- You have a history with your home bank.

- They have most of your details.

Thus, taking out a mortgage from your home bank is easier.

Contact other banks for mortgage possibilities.

You should contact at least two more German banks for mortgage offers. The reasons for contacting other banks are:

- Different banks offer different mortgage conditions.

- Few banks may reject your mortgage application. But that doesn’t mean you cannot get a mortgage elsewhere.

- You get an idea of the current home loan market.

- You can bid one bank against another to get the best German mortgage rates.

Contact mortgage brokers for further mortgage offers

The mortgage brokers are middlemen who have relations with several banks. They connect banks and potential clients.

Mortgage brokers can explain the complete German mortgage and house-buying process to you. They can also help you find the right mortgage product.

Mortgage brokers earn a commission from the bank after a deal is closed. So, they offer free consultation to potential home buyers.

There are many mortgage brokers in Germany. The major payers are Dr. Klein* and InterHyp*.

Mortgage brokers in Germany

- Offer support in finding the right mortgage product.

- Help you understand the process of buying a property in Germany.

- A mortgage broker can find mortgage options from several banks within minutes.

How do you calculate the maximum German mortgage you can get yourself?

The maximum amount of mortgage you can get depends on your financial situation, i.e.,

- Your net income

- Your age

- The cash you bring to the table

Here are the steps to calculate the maximum mortgage amount.

- The bank will deduct your expenses from your net income.

- The amount left can be the maximum monthly installment you can pay.

- Lastly, banks multiply that amount by the number of years you can work until retirement.

- The sum you get is the maximum mortgage you can get.

⚠️ NOTE: You have to bring at least “Nebenkosten” from your own pocket to be eligible for the mortgage. “Nebenkosten” is approximately 7% to 12% of the property’s purchase price.

So, if you want to borrow 700k € from the bank, you must bring at least 70k € to 84k € from your pocket.

Learn more about it in our guide on mortgage interest calculation by banks in Germany.

Things to keep in mind while contacting banks and brokers to get a loan offer

- Wait till the bank approves the mortgage offer. Mortgage brokers can present you with different mortgage options. But these mortgage offers are tentative. Mortgage brokers must send your profile to the banks for approval. Thus, the mortgage terms may change until you have an approval from the bank. In the worst-case scenario, a bank may reject your home loan application even if the broker thought you were eligible.

- Kredit Anfrage vs Konditionen Anfrage. Submitting a loan request (Kredit Anfrage) affects your SCHUFA score. But, requesting mortgage conditions (Konditionen Anfrage) doesn’t. It’s a small thing, but it has a significant impact. Thus, confirm with your bank that the request should not affect your SCHUFA score.

Understanding important German mortgage terms and conditions

There are four essential mortgage conditions you should be aware of.

- The mortgage interest rate offered by the bank.

- How does the bank calculate the mortgage interest?

- Possibility of special repayments (Sondertilgung).

The mortgage rate offered by the bank in Germany

It’s a no-brainer that the lower the mortgage interest is, the better it is. But, a lower interest rate is not always better.

The effective interest may vary drastically based on how banks calculate the interest. You should also look for the fixed interest period.

During the fixed internet period, your interest rate doesn’t change. In the low-interest periods, having long fixed interest is recommended.

Possibility of special repayments (Sondertilgung) in your mortgage contract

- Sondertilgung is an optional loan repayment choice. You can pay a certain amount once every year on top of monthly installments.

- The amount you repay is deducted directly from your loan’s Principal. Hence, you can use it to repay your loan early and pay less interest.

- Banks define Sondertigung as a percentage of your loan amount. Normally, it’s 3% or 5% of the loan amount.

For example, if the Sondertilung is 5% and your loan amount is 100k €. Then, you can repay up to 5k € once every year without any penalty.

💡 TIP: It’s recommended having Sondertilgung as an option in your mortgage contract.

Having the Sondertilung option in your contract does not imply that you must pay it yearly. You can decide to pay 2k, 4k, or nothing.

How does the bank calculate the mortgage interest?

The borrowing rate offered by various banks can be the same, but how banks calculate interest may vary.

How banks calculate the interest rate can significantly affect the effective interest rate. There are two ways banks in Germany calculate the mortgage interest.

- Interest on the principal left

- Fixed interest throughout the loan term

Calculate the interest rate on the principal left.

In this case, the bank calculates the interest on the principal left. The principal reduces over time as you repay the mortgage.

Thus, the interest part of the monthly installment also reduces with time.

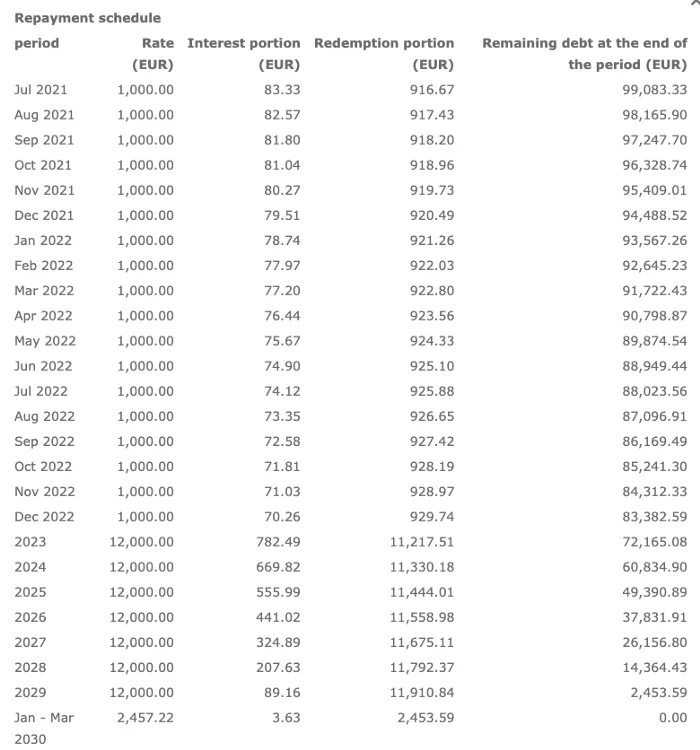

For example, you took a mortgage of 100k € at a 1% borrowing rate per annum. You chose a monthly installment of 1000 €, consisting of a principal (916 €) and interest (84 €).

You’ll pay a total interest of 4457 € to repay the entire mortgage.

The image shows the repayment plan of the borrower.

Fixed interest throughout the loan term (also called annuity loan)

In this case, the bank calculates the interest on the issued loan (i.e., $100k) and not the principal left.

It means that the interest portion of the monthly installment is the same throughout the loan term (i.e., $84).

In this scenario, you’ll pay TWICE the interest you paid in the previous case.

The borrower will take approximately nine years (100k / (916*12)) to repay the mortgage. Thus, interest paid in 9 years will be 9072 € (9*12*84). It’s twice the interest paid in the previous scenario.

Thus, always check how the bank is calculating the interest.

List of documents you need to apply for a mortgage in Germany

Banks will need your and the property’s documents to offer a mortgage. Let’s first check the documents the bank needs from you.

Your (borrower) documents to apply for a mortgage in Germany

If you’re employed:

- Last 2 or 3 months’ salary slips

- December salary slip of the previous year

- Lohnstuerbescheid/Einkommenstuerbecheid: It summarizes the salary you received in a particular year. You get this document from your employer every year.

- Job contract: Banks prefer to give a mortgage to someone with a permanent (Unbefristet ) working contract.

If you are self-employed, the bank would like to see a stable source of income. To prove it, you have to show:

- Financial statement of your business, i.e., Balance sheet, Income statement, and Cash flow statement.

- 2 or 3 years of business tax returns

- 2 or 3 years of your tax returns

The bank may ask for other documents based on your business or nature of work.

Other documents:

- Insurance contracts, if any. E.g., life insurance, Car insurance, etc. Banks want to know what portion of your income goes into paying insurance premiums.

- Proof that you can pay Nebenkosten. You can prove that by showing one or a combination of the following.

- Account statements

- Bauspar konto, if any

- Stock trading account

- Any other mortgage-friendly scheme you are enrolled in.

- Retirement account statements (Rentenversicherung): The document shows the amount in your retirement fund and approximate monthly income after you retire.

- For banks, it’s preferable that you pay back the mortgage before retirement. But, if it’s not possible, this statement helps banks decide whether the borrower can repay the mortgage after retirement. So the younger you are, the better it is.

- You receive this document automatically once per year.

- You can also request the document online from Deutsche Rentenversicherung’s website.

- Personal identification documents: Passport and Permanent residence card (Niederlassungerlaubnis).

⚠️ Note: If you do not have a permanent residence or citizenship, getting a mortgage could be difficult.

Lastly, if you are applying with your spouse, the same documents would also be required for your spouse.

Applying together with a spouse doesn’t improve the interest rate, but it increases the amount of credit you can get.

Property documents you need to get a loan in Germany

- Property expose: Expose contains the basic information about the property

- Property address

- Construction year

- Purchase or Ask price

- Broker’s commission, if any

- Property’s images, etc.

- Living area calculation (Wohnflächenberechnung): The document shows the size of every space/room of the property.

- Floor plan (Grundriss): A type of drawing that shows the property’s layout from above.

- Site plan (Lageplan): The document shows a large-scale drawing of the full extent of the site for an existing or proposed development.

- Land register papers (Grundbuchauszug): The document shows the names of the current and previous owners, third-party rights (e.g., mortgage), and the description of the property.

- Energy efficiency certificate (Energieauweis): The document shows the energy efficiency of the property or property building.

- Declaration of division (Teilungserklärung): As the name suggests, it documents how the property is divided. So, which portion of the property building belongs to you, and which comes under the House Union?

- Rent contract (Mietvertrag): The bank will also require this document if you buy a rented property.

The above list covers the minimum set of documents a bank may request. Banks may ask for further documents depending on your situation and the property you plan to buy.

Read our guide on German property documents to learn more.

How do you negotiate with German banks to get the best mortgage offer?

You can negotiate with banks on the following terms of the mortgage contract.

- Effective interest rate (Effectivzins): The lower, the better. But keep an eye on how banks are calculating the interest.

- Monthly installment: Investors prefer a lower monthly installment to achieve maximum positive cash flow.

- Fixed vs. variable interest rate: Fixed interest rate means the borrowing rate will remain fixed throughout the mortgage tenure. A variable interest rate means the borrowing rate may change during the mortgage tenure. During the low-interest period, the longer the fixed interest, the better.

- Mortgage tenure: Length of the mortgage contract. The interest rates increase with the length of the mortgage tenure. So, you’ll pay a higher interest rate with a longer mortgage tenure. So, find the right balance based on your situation. In Germany, you don’t have to repay the mortgage by the end of the mortgage tenure. You can refinance the remaining principal instead.

- Insurances or other schemes on top of the mortgage: Some banks make taking insurance or other schemes mandatory. Taking insurance is not free. The insurance premium is part of the monthly mortgage payment.

Contact banks and mortgage brokers like Dr. Klein* and InterHyp* to explore mortgage possibilities.

Different banks will present different mortgage offers. You can use these offers to bid banks against each other.

Don’t hesitate to negotiate or bargain with banks. You will be surprised by how flexible banks can be.

The following steps remain once you find the right mortgage offer.

- You must finalize the bank and submit all the required documents.

- The bank will evaluate all the documents and the property. If everything is fine, the bank will prepare the mortgage contract.

- You can proofread the contract to check if everything looks right. If yes, then you are good to sign it.

💡TIP: We recommend signing the mortgage contract a week before signing the purchase contract (Kaufvertrag).

As per German law, you get 14 days to cancel the mortgage contract without giving any reason. It is called “Widerrufsrecht” in German.

So, if something goes wrong and you do not get the property, you can cancel the mortgage contract without penalty.

Expats guide to buying a house in Germany

- The process of buying a house in Germany.

- How do you evaluate a property in Germany?

- What documents should you check before buying a house in Germany?

- How do you get a mortgage from a German bank?

- Tips and tricks to save thousands of euros.

- Average renovation costs in Germany and more…

Financial terms used in a mortgage contract

Darlehensbetrag (Loan amount or Principle)

It means how much credit you want to take from the bank.

If you take less than the property’s purchase price, you must prove that you can finance the remaining amount.

You can even take a higher loan. For example, a loan to renovate the property. You can also check home renovation loan offers on Finanzcheck*, Tarifcheck*, and Verivox* online brokers.

Nebenkosten (Property purchase cost)

Nebenkosten is the amount that covers home-buying costs in Germany. It’s the sum you need on top of the property’s purchase price.

Nebenkosten is around 7% to 12% of the real estate purchase price.

So, for example, you want to buy a property whose sale price is €250k. Then, you need to bring 17.5k (7% of 250k) to 30k (12% of 250k) from your pocket.

Thus, the total cost to buy the apartment is 250k € + (17.7k to 30k) €.

Nebenkosten percentage depends on two factors:

- Land transfer tax in the province where you buy a property

- Real estate agent commission.

Different provinces in Germany have different land transfer taxes. For example, as of 2024, the land transfer tax in Bayern is 3.5% and 5% in Baden-Württemberg.

Different real estate agents charge different commissions. You’ll save some money if you don’t buy the property via a real estate agent.

Tilgung (Monthly installment)

Tilgung is your monthly installment. You don’t have to repay your mortgage within the loan term. You can refinance the remaining mortgage at the end of the loan term.

Banks ask you how much Tilgung/monthly rate you prefer.

You can answer it in 2 ways.

- You can tell them the amount in euros. For example, 600 € every month.

- You can tell them in percentage. For example, you want to repay 2% of the mortgage principal annually.

Sollzinssatz (Interest Rate)

Sollzinssatz means the interest rate. It is the interest that you will pay on your loan. The lower, the better.

Dauer der Sollzinsbindung (Mortgage period)

It means the mortgage period (10, 15, 20 years).

Usually, the longer the mortgage period, the higher the interest rates. So, you need to break a balance between the mortgage period, monthly installment, and interest rate.

Sondertilgung (Special repayment)

Sondertilgung is an optional payment once every year on top of monthly installments.

Restschuld (Pending debt)

It is the amount left after your mortgage term ends. You can refinance the Restschuld with the same or different bank.

Kredit Anfrage (Request a loan)

It means to request a loan from a bank. This request affects your SCHUFA score. Hence, you should request loan conditions (Konditionen Anfrage) instead.

You can also tell the bank consultant that the loan inquiry shouldn’t affect your SCHUFA score.

Konditionen Anfrage (Request for loan conditions)

It is the request to know the loan conditions a bank offers. It doesn’t affect your SCHUFA score.

FAQ

Is it possible to get a loan that is more than the property’s purchase price?

Yes, you can get a higher loan than the property’s purchase price. The typical scenario is getting a renovation and mortgage loan.

Can you repay the mortgage before the mortgage tenure ends?

Yes, you can repay the mortgage before its tenure ends. But you may have to pay a penalty. Whether you must pay a penalty depends on the mortgage terms.

You can repay the mortgage after three years penalty-free if you live on the property. And after ten years, if you don’t.