Key takeaways

- You can deduct dental treatment costs not paid by the health and dental insurance from your taxes.

- The dental expenses that you can deduct from taxes must be medically necessary.

- The amount of dental costs that exceeds the reasonable burden is tax deductible.

- You also deduct supplementary dental insurance contributions from your income tax.

This is how you do it

- Keep the dentist invoices and medicine receipts for the year.

- Keep the invoices for other medical treatments for the tax year.

- Enter the medical expenses on your tax return as extraordinary expenses.

- Enter your dental insurance premiums as precautionary expenses on your tax return.

- You can use one of the recommended online services to file income tax in Germany. We recommend SteuerGo*, Wundertax*, and Smartsteuer*.

Table of Contents

Deduct Dental Expenses From Taxes

Can you deduct dental costs from taxes in Germany?

Yes, you can deduct medical expenses, including dental treatment costs, from your income tax return in Germany. Medical expenses not covered by health insurance or additional private insurance are considered extraordinary expenses.

However, you can deduct the medical expenses if they fulfill the following requirements.

- The treatment was medically necessary.

- The treatment cost exceeds the reasonable burden (Zumutbare Belastung).

The amount the tax office considers a reasonable burden depends on your

- income,

- marital status,

- and the number of children.

How do you calculate a reasonable burden for medical expenses?

The table below shows what percentage of income is considered a reasonable burden. Medical expenses that exceed this percentage are tax deductible.

| Income up to €15,340 | Income from €15,340 to €51,130 | Income over €51,130 | |

| Without children | |||

| Basic tariff / single | 5% | 6% | 7% |

| Splitting tariff / married | 4% | 5% | 6% |

| With children | |||

| One or two children | 2% | 3% | 4% |

| Three or more children | 1% | 1% | 2% |

Source: § 33 Einkommensteuergesetz

The tax authorities consider GdE income to calculate a reasonable burden. GdE income is the gross income minus the age relief amount, the allowance for farmers and foresters, and the allowance for single parents ( Section 2 Paragraph 3 EStG ).

For example, suppose you are single with no child and earn 50k € gross per annum. You don’t get any of the above-mentioned allowances. Thus, your GdE income is the same as your gross income.

In this case, your reasonable burden is 6% of 50k, i.e., 3000 €.

Suppose your medical expense was 4000 €. Hence, you can deduct 1000 € (4k – 3k) from taxes.

You can also use the calculator from the tax office to calculate the tax-deductible amount.

How do you deduct dental costs from taxes in Germany?

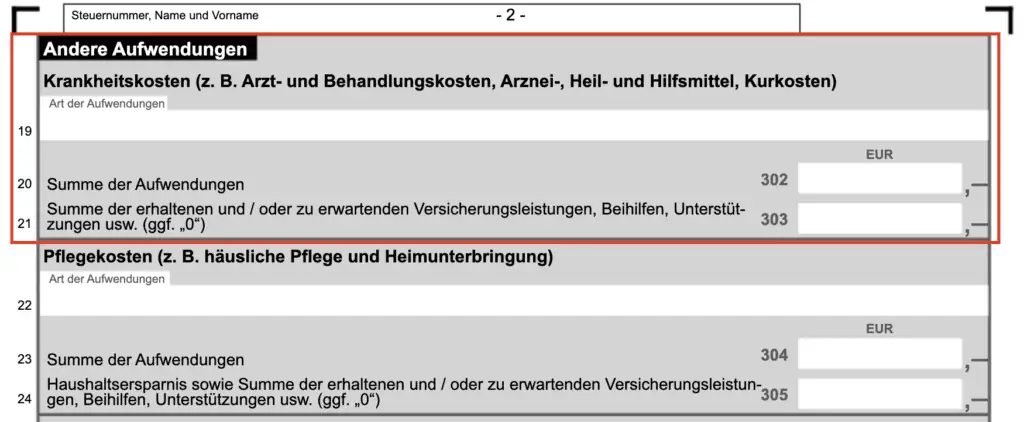

You enter medical expenses for dental treatment or dentures in the extraordinary expenses appendix (Anlage Außergewöhnliche Belastungen).

Enter the dental costs under “Andere Aufwendungen -> Krankheitskosten (z. B. Arzt- und Behandlungskosten, Arznei-, Heil- und Hilfsmittel, Kurkosten).” You can find the section on line 19 (2023 tax form)

You can use one of the recommended online services to file income tax in Germany. We recommend SteuerGo*, Wundertax*, and Smartsteuer*.

File Income Tax with SteuerGo

- 34.95 € for filing a single income tax return

- Easy to file and save tax.

- The tool is also available in English.

- Get tax-saving tips to maximize your tax return in the current and the following years.

File Income Tax with Smartsteuer

- 39.99 € for filing up to 5 income tax returns for a particular tax year.

- Save by filing income tax with your friends.

- Only available in Germany

File Income Tax with Wundertax

- 34.99 € for filing a single income tax return

- Tips on deductible costs & plausibility check

- Try it out for free & only submit if you’re fully satisfied

- Also available in English

Tips on deducting dental expenses from your income tax return

- Keep the invoices for your dental and other medical treatments for the year.

- You should also keep the medicine and prescription bills. You should not underestimate the small medical bills. They can quickly add up to a large amount over the year.

- Try to plan your medical treatments in the same year. It increases your chances of exceeding the reasonable burden limit. For example, you get dental treatments and purchase new glasses in the same year.

Deduct Dental Insurance From Taxes

Deduct dental insurance contributions from taxes in Germany

You can deduct insurance contributions from taxes in Germany. This includes dental insurance premiums also.

The tax office considers insurance premiums as precautionary expenses. However, the tax office set a limit on the amount of precautionary expenses you can deduct. It’s 1900 € (as of 2023) for employed individuals.

So, you can deduct a maximum of 1900 € (as of 2023) in insurance contributions per annum from taxes. But this includes the contributions to pension, health, long-term nursing care insurance, etc.

Contributions to legally required insurance are usually more than 1900 € per annum. Thus, there is little room to deduct dental insurance premiums from taxes.

However, you can deduct dental insurance contributions if you have low health insurance premiums. For example, you are insured under free family health insurance or have student health insurance.

Nevertheless, you should declare all your insurance expenses in the tax return. The tax office will deduct them up to the maximum limit (i.e., 1900 € as of 2023).

Maximum insurance contributions you can deduct from taxes in Germany?

The maximum insurance premiums you can deduct from taxes depends on your employment and family status.

| Employed, Student, Retired, Civil Servant | Self-employed | |

| Single | 1900 € | 2800 € |

| Married couples filing joint tax return | 3800 € | 5600 € |

The maximum limit is 4700 € if one partner is employed (1900 €) and the other is self-employed (2800 €).

How do you deduct supplementary dental insurance from taxes in Germany?

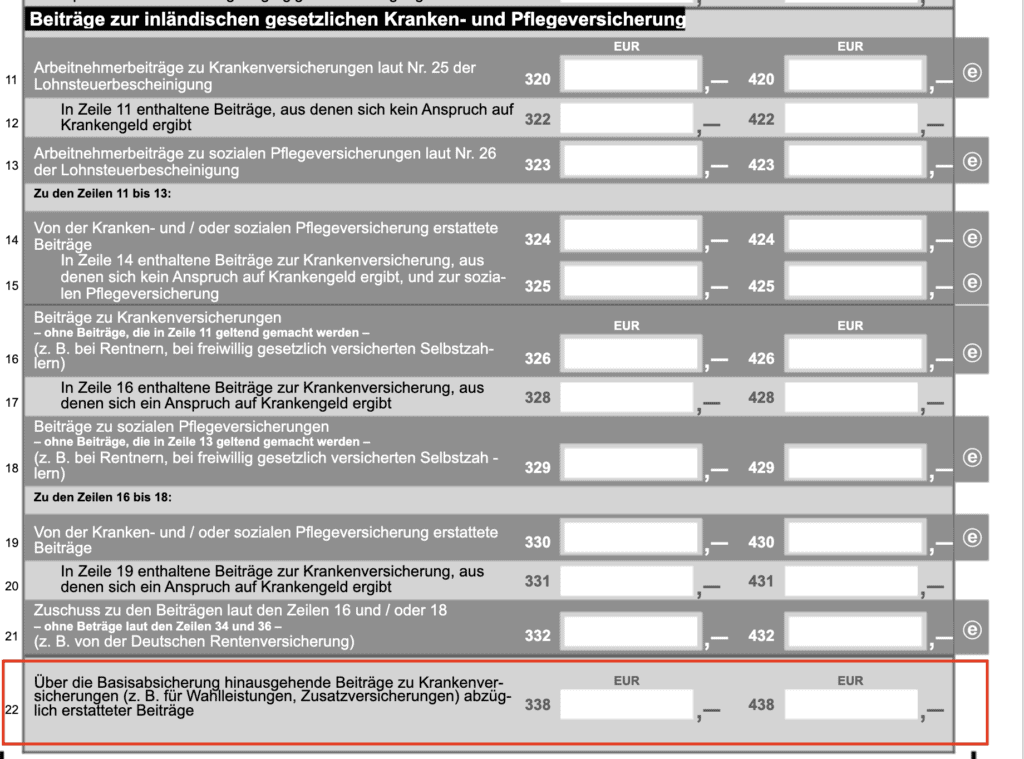

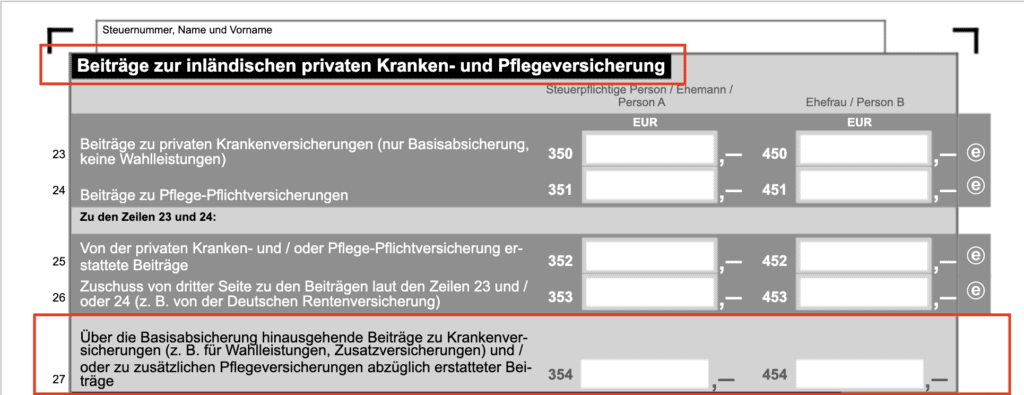

You enter dental insurance contributions in the “Precautionary expenses appendix (Angaben zu Vorsorgeaufwendungen)” under section “über die Basisabsicherung hinausgehende Beiträge zu Krankenversicherungen.”

If you have statutory or private health insurance, the section can be found on line 22 or 27 (2023 tax return form), respectively.