Key Takeaways

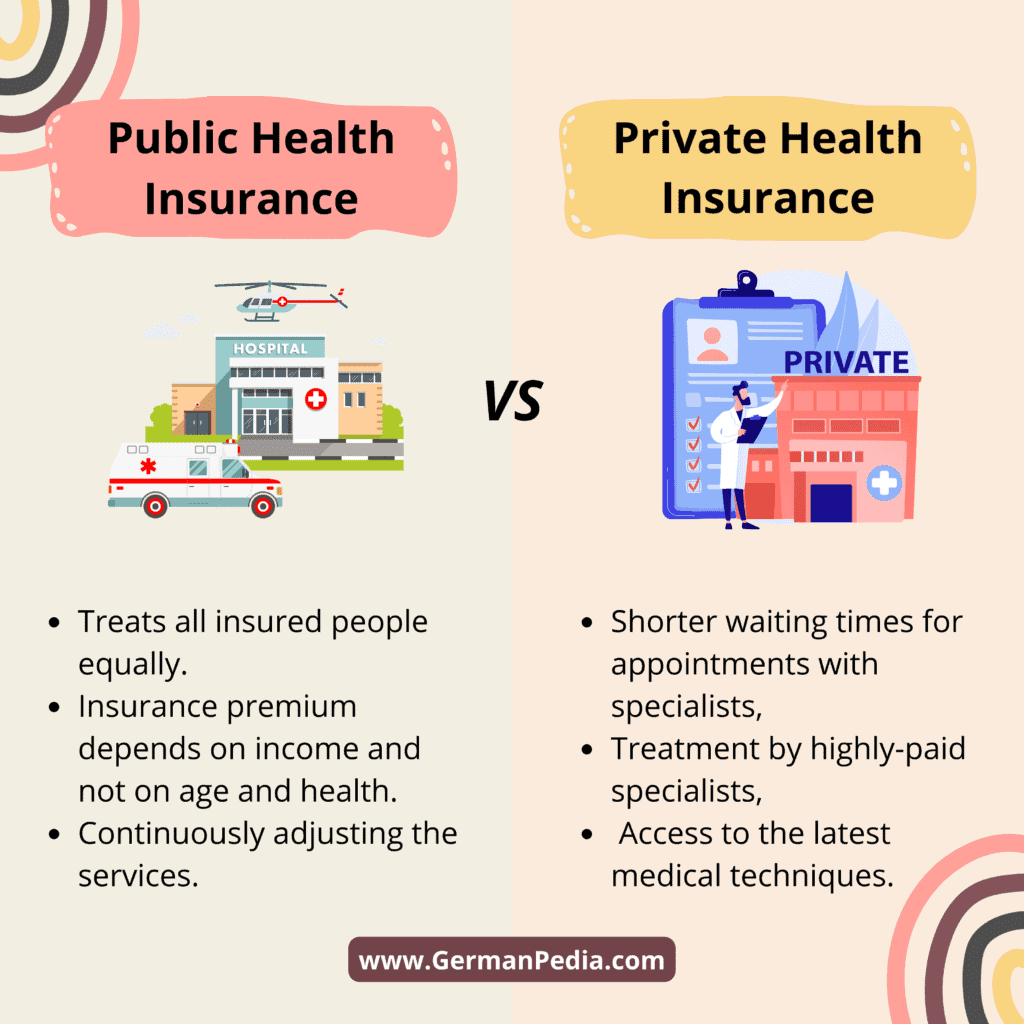

- In Germany, you are legally required to have health insurance. You can choose between private and public health insurance.

- The public health insurance premium depends on income, while the private health insurance premium depends on age and health.

- Only people who earn more than the income threshold, i.e., 69,300 € (as of 2024), are eligible to get private health insurance in Germany.

- Public insurance providers are continuously removing or limiting the services they offer. However, private insurance companies cannot change your contractually agreed benefits.

- Civil servants and high-earners benefit the most from private health insurance.

This is how you do it

- Before deciding between public or private insurance, you should weigh the pros and cons of both healthcare systems in the long term. You can use our “Health Insurance Finder” tool to check which health insurance (Public or Private) makes sense and when.

- You must pay close attention to the services, benefits, and insurance premiums while picking a health insurance policy in Germany.

- Consult a fee-based advisor or insurance broker to get personalized advice. You can contact one of the experts we recommend using this form for free.

- In our comparison and test, we found Haellesche and Signal Iduna’s private health insurance plans to be the best.

- If you want English customer support, you can get private health insurance from Feather*. They are an insurance agent and sell Haellesche’s private insurance plans.

Table of Contents

It’s not easy to compare the benefits of public and private health insurance in Germany. Many of the services provided by public and private health insurance systems are the same.

Still, there are fundamental differences between the two healthcare systems. For example, health insurance costs calculation, different insurance plans offered by the two, etc.

Private vs. Public health insurance in Germany

| Parameter | Public health insurance | Private health insurance |

|---|---|---|

| DOCTOR | | |

| Selection | You can only go to doctors who accept public health insurance. | ✅ You have a free choice of doctor selection. You can go to any doctor. |

| Appointment | It takes 3 to 6 months to get an appointment with a specialist in Germany if you have public insurance. | ✅ You can get an appointment within a week or the same day. |

| Invoice | ✅ The insurer settles the invoice directly. | You are responsible for settling the invoice. You submit the invoice to the insurance company, and they usually reimburse you for the costs within a few days. |

| Drugs | – The patient pays 10% of the prescribed medicine’s cost (min. €5, max. €10) – No reimbursement for over-the-counter drugs. | ✅ Full reimbursement of all medicines – a deductible may apply. (depending on your tariff) |

| Psychotherapy | ✅ The insurer covers the approved therapy costs ✅ Depending on the treatment, max. 300 sessions | – Whether and to what extent costs are covered depends on the tariff – Usually limited to a few sessions (20 – 30 per year) |

| Aids / Services (wheelchairs, prostheses, etc.) | The insurer covers the costs of services (aids) mentioned in a directory that is revised regularly. | – Often, a limited catalog of services that are not adopted regularly – Often, the limited scope of reimbursement |

| Change in medical services | Public health insurance is continuously removing or limiting the medical services it covers. | ✅ Private health insurance companies cannot remove or limit the contractually agreed medical services. |

| HOSPITAL CARE | | |

| Hospital | Admission to the nearest suitable clinic | ✅ Free choice of hospital or private clinic possible depending on the tariff |

| Accommodation | Shared rooms | ✅ Private or double rooms, in a few tariffs multi-bed rooms |

| Treatment | Doctor on duty | ✅ Chief physician Doctor on duty in a few tariffs |

| COST | ||

| Premium calculation | Premium is calculated based on your income. You pay less if you earn less and pay more if you earn more. | Private health insurance premiums are calculated based on age, existing illnesses, and tariffs. Income doesn’t play a role, which is why private insurance is beneficial for high-earners. |

| Premium increase | Public insurance premiums are increasing at a rate of 3.3% p.a. for the last 10 years. | ✅ Private insurance premiums are increasing at a rate of 3.2% p.a. for the last 10 years. |

| Future outlook | The future of the public healthcare system in Germany doesn’t look good. It’s because of the aging population and decreasing number of young professionals. Moreover, public system is not prepared for the future. | ✅ The private healthcare system is better prepared for the future with an aging provision of 335 billion euros as of July 2024. |

| DENTIST | | |

| Treatment | – Full assumption of the dental costs of basic care (e.g., amalgam fillings) – Subsidy for more expensive fillings/inlays. | – No restriction to basic service. ✅ Pays 50% to 100% of the costs, depending on the tariff. |

| Dentures | Pays a subsidy of 60% on the basic service (max. 75%, with a complete bonus booklet). The patient must cover the remaining costs, e.g., for inlays/implants. | ✅ Depending on the tariff, the company pays 50% to 100% of the costs. Often with a limit on the sum. ✅ Few tariffs also cover the implant costs. |

| UNABLE TO WORK | | |

| Sick pay | ✅ The insurer pays 70% of your gross income or max. 90% of net income from the 43rd day of sick leave. ✅ The same applies to leaves in the case of a sick child. – Sick pay is limited to 120.75 € per day (as of 2024). | – When and how much the insurer will pay depends on your insurance plan. – The insurer doesn’t pay in the case of a sick child. ✅ You can decide on a higher sick pay when concluding the contract |

| Maternity Protection | – Max. 13 €/day maternity allowance from the health insurance company – The employer tops the maternity allowance to bring it closer to the net salary. – Special rules for voluntarily insured persons. | Max. 210 € maternity benefit from the “Federal Insurance Office” depending on the tariff |

| Maternity leave | ✅ You don’t have to pay insurance premiums during maternity leave. | Usually, you pay monthly insurance contributions during maternity leave. |

| SWITCHING INSURANCE | ||

| Changing health insurance provider | ✅ You can change public health insurance providers anytime without consequences. | Changing a private health insurance provider is expensive. Even changing your health insurance plan with the same provider can be expensive. |

| Switching between private and public insurance | ✅ If you meet the eligibility criteria, you can switch to private health insurance anytime. | Returning to public health insurance is tough, even if you are unemployed or earn below 69,300 € (as of 2024). |

| IN THE EVENT OF DISPUTE | ||

| Cost to sue the insurance company | ✅ You can object to the health insurer’s decision free of charge. | No legally regulated right to object |

| Legal costs | ✅ Court and lawyers’ fees are not based on the value in dispute but are limited by law. | Legal costs depend on the value in dispute. Thus, you may incur higher costs. |

| If you lose the dispute | ✅ You bear only your legal costs. You don’t pay the legal costs of the insurance company. | You bear your and your insurance company’s legal costs if you lose the dispute in court. |

Health insurance finder

Determining which health insurance is right for you can be confusing. So, we created this tool to help you decide.

Answer a few questions, and the tool will tell you which health insurance best suits your current situation.

Private health insurance pros and cons

| Pros | Cons |

|---|---|

| Civil servants and self-employed (high-earners) can save between 250 € and 500 € per month with private health insurance. | Private health insurance is expensive for families with children. It’s because you cannot insure your non-working spouse and children for free in private health insurance. |

| You get better medical services with private health insurance | Returning to the public healthcare system is difficult and gets impossible with age. |

| Private insurance members get a specialist’s appointment within a week or the same day. | Changing private health insurance companies is expensive. You lose most of your retirement provisions when you change the insurance provider. |

| Dental coverage in private health insurance is better than in public. | Private health insurance companies have the right to choose their customers. Thus, they reject unhealthy applicants. |

| High earners pay less premiums for private insurance than for public insurance. | If private health insurance must accept an unhealthy customer, they offer basic plans or charge high premiums. |

| The private health insurance premium for high earners in old age is still lower than the public health insurance premiums. | Private health insurance gets expensive as you age. To keep the premium reasonable in old age, you must join private health insurance when young to build up retirement provisions. |

| The private healthcare system is better prepared for the future. It has saved a retirement provision of 335 billion euros as of July 2024. The insurer uses the retirement provision to keep the insurance premium stable in old age. | You must continue to pay private health insurance premiums during maternity leave. |

We recommend consulting an insurance broker or a fee-based adviser for personalized advice before taking private health insurance in Germany.

Insurance brokers and advisors are liable for their advice. This means that if the insurance plan they recommended doesn’t fulfill your wishes, they are liable to pay the damages.

Insurance brokers offer free advice. The insurance company pays them upon the successful conclusion of the contract.

An insurance broker can also help you file a claim with the provider. The broker we recommend has been offering services to expats for more than a decade.

You can contact the insurance brokers we recommend using the below form.

Consult an health insurance broker

NOTE: Insurance brokers are liable for giving you advice. This means that if you asked for a particular coverage and the insurance policy recommended by them didn’t cover it, they are liable to pay for the damages

NOTE: In our comparison and test, we found Haellesche and Signal Iduna’s private health insurance plans to be the best.

Public health insurance pros and cons

| Pros | Cons |

|---|---|

| Every member of public health insurance enjoys the same medical services irrespective of their insurance premium. | Unlike private health insurance, public health insurance offers basic services only. |

| Public health insurance premiums depend on income. So, low-earners pay less premium than high-earners. | Because the public insurance premium depends on your income, it’s expensive for high earners. |

| Anyone can join public health insurance. People who earn lower than the income threshold (69,300 € as of 2024) are compulsorily insured in public insurance. And high earners can voluntarily join the public system. | Dental coverage is very basic in public health insurance. You must get a supplementary dental insurance policy to cover the costs of dental treatment. |

| You can insure your non-working spouse and children for free under your public health insurance. | Getting a specialist appointment can take months for public health insurance members. |

| You can insure yourself for free under your spouse’s public health insurance during parental or maternity leave. |

Register with TK

- Biggest public health insurance company in Germany based on number of members.

- Enjoy low premiums

- Get English customer support, website, and mobile app.

- Complete the application process in English.

Health insurance cost in Germany

Private health insurance

Private health insurance costs depend on your age, health, and the insurance plan you pick. Hence, the insurance contribution amount can vary drastically for each person.

However, a good private health insurance costs between

- 466 € and 683 € per month to self-employed

- 301 € and 355 € per month to employees

- 288 € and 400 € per month to civil servants

- 120 € and 200 € per month to students

Read our guide on private health insurance cost development in the past and future forecasts to learn more about premium development with time.

Public health insurance

Public health insurance premium is a percentage of your salary. This is how much it cost.

Employed and Self-employed

- Employed people pay 14.6 percent of their monthly gross income plus an additional contribution (Zusatzbeitrag in German). Self-employed can pay 14% or 14.6% of their gross income plus an additional contribution.

- The additional contribution (Zusatzbeitrag) amount depends on your health insurance provider. However, the average additional contribution is 1.7% as of 2024.

- You also pay 3.6% or 4% for long-term nursing care insurance.

- Your non-working spouse and children are insured for free in your public health insurance.

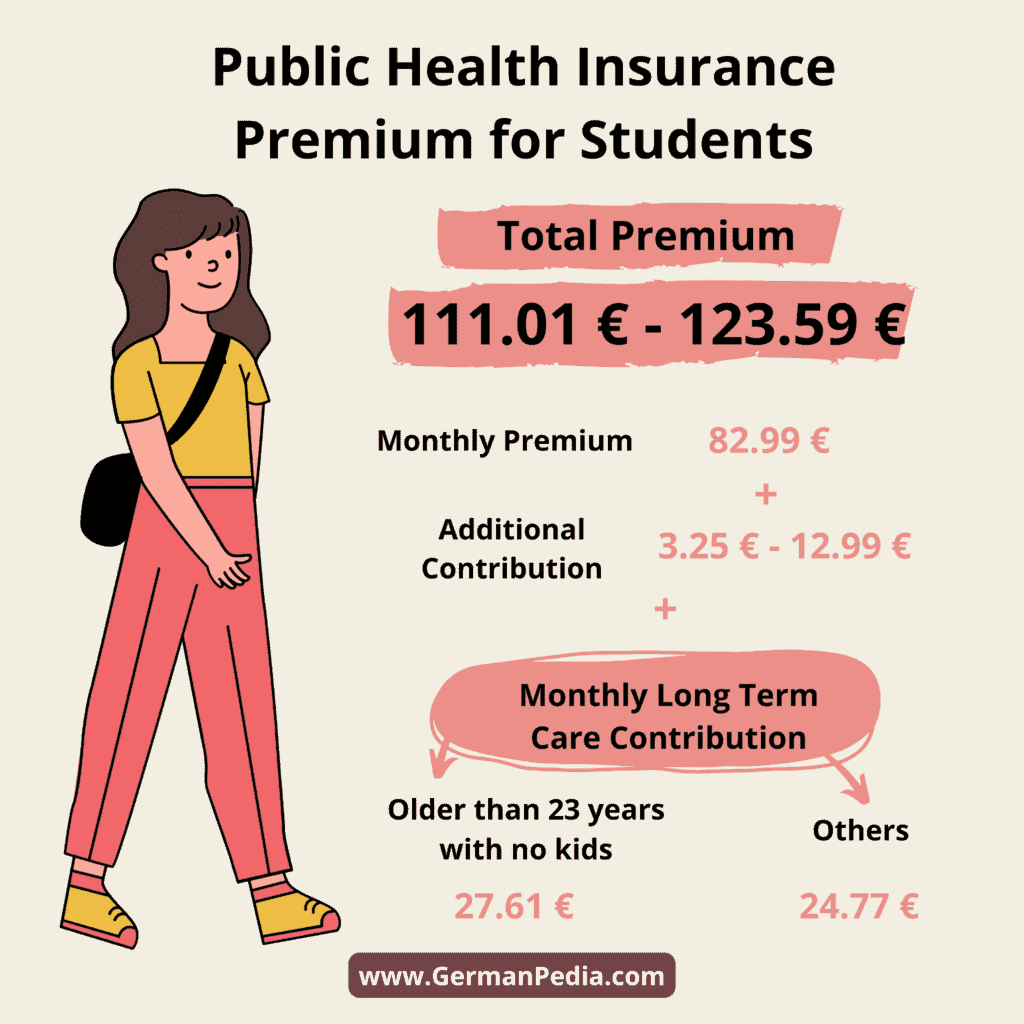

Student

- Students under 23 pay around 120 € per month for public health insurance, and students between 23 and 29 pay around 125 €.

- Students aged 30 or older do not get discounted student health insurance from public insurers. They can take the standard public health insurance in Germany. It costs 222 € per month as of 2024.

- Your non-working spouse and children are insured for free in your public health insurance.

Unemployed

- Unemployed individuals pay the minimum insurance premium, i.e., 219.17 € or 226,24 € per month as of 2024.

The maximum income public health insurance companies consider for calculating the premium is 5175 € per month (as of 2024). It was 4987.50 € per month in 2023.

So, even if you earn more than 5175 €, your premium won’t increase further.

The German public insurance companies divide the income into four sections and calculate the public insurance premium differently for each.

| Category | Income | Public insurance premium |

|---|---|---|

| Minijobs | Less than 520 € per month | 14.6% of 1,131.67 € = 165 € per month |

| Midijobs | 2000 € per month | The premium percentage decreases with salary. 10.8 % is the lowest and 14.6% is the max. |

| Employee tariff | More than 2000 € and less than 5175 € per month | 14.6% of your monthly income. |

| Maximum monthly income limit | More than 5175 € per month | 14.6% of 5175 € = 755 € per month. |

Social nursing care insurance cost (Pflegeversicherung in German)

The nursing care insurance costs 3.4% of the monthly gross income if you have children. It increases to 4% if you don’t have any children.

The maximum income threshold for calculating the nursing care insurance cost is 5175 € per month (as of 2024).

The employer shares half of the insurance cost of employees with children. But in some federal states, the cost split is different.

The table below shows how the nursing care insurance cost is split among the employee and the employer.

NOTE: Self-employed people have to pay the whole amount themselves.

| Share employees with children pay | Share employees with no children pay | Share employer pays | |

|---|---|---|---|

| Sachsen | 2.2% | 2.8% | 1.2% |

| Other federal states | 1.7% | 2.3% | 1.7% |

| Total insurance cost (Employee’s share + Employer’s share) | 3.4% | 4% |

In total, you pay public health insurance and nursing care costs every month.

Do German employers contribute to the health insurance premium?

Public health insurance

German employers pay half of the public health insurance contribution for their employees.

Private health insurance

German employers pay half of the private health insurance premium for employees. However, it is only up to the maximum rate of a statutory insured person, which is 422 € per month as of 2024. It was 404 € per month in 2023.

Read our guide on employer’s contribution to private health insurance to learn more.

NOTE: Self-employed must pay the whole premium themselves.

Can German health insurance benefits change over time?

Change in public health insurance benefits

The German health system constantly adjusts the list of services provided by statutory health insurance.

Thus, it’s uncertain which services the public health insurance providers will cover in the future.

For example, recently, politicians abolished the reimbursement of over-the-counter medicines and reduced the subsidies on dentures.

Change in private health insurance benefits

In contrast, private health insurance companies cannot easily adjust the list of services covered by them.

Once you sign a contract with the private health insurer, you and the insurer cannot change the contractually agreed healthcare services.

So, if a new medical treatment is available but is not part of your private insurance plan, the insurer will not cover its costs.

Hence, changing the health insurance plan is the only way to opt for or change your healthcare services.

However, changing to a different tariff can come with hurdles, such as a health check and possibly higher premiums.

How do I find the right health insurance policy?

Public health insurance

All public health insurance companies offer almost the same services. Hence, it only matters a little which company you pick.

The difference lies in the additional contributions (zusatzbeitrag in German) and non-basic benefits like travel vaccinations, alternative healing methods, etc. Thus, it’s better to be insured with a health insurer that has low premium.

You can use our public health insurance cost calculator to check how much you can save by moving to a cheaper health insurer.

We find TK to be the best public health insurance company for expats. It’s one of the cheapest insurers and offers English customer support.

Register with TK

- Biggest public health insurance company in Germany based on number of members.

- Enjoy low premiums

- Get English customer support, website, and mobile app.

- Complete the application process in English.

Private health insurance

Finding the right private health insurance provider and tariff is more complicated.

- Consult a fee-based advisor or insurance broker to get personalized advice. You can contact one of the experts we recommend using this form for free.

- In our comparison and test, we found Haellesche and Signal Iduna’s private health insurance plans to be the best.

- If you want English customer support, you can get private health insurance from Feather*. They are an insurance agent and sell Haellesche’s private insurance plans.

You should also understand the essential services a private health insurance plan should cover. We have created a checklist you can use while consulting an insurance advisor.

Conclusion: Is private health insurance worth it?

Private health insurance is not always better than public health insurance. A private insurance tariff with comprehensive services also costs a lot.

Moreover, you must ensure you can afford the rising private health insurance prices in the long term. In most cases, it’s best to take out public health insurance.

NOTE: The purpose of getting health insurance is to have good coverage when you or your loved ones are sick. Thus, you should not base your decision solely on which health insurance is cheaper.

You can use our “Health Insurance Finder” tool to check which health insurance (Public or Private) makes sense and when. We recommend getting advice from a fee-based advisor or health insurance broker before deciding.

Private insurance is only worthwhile for

- Self-employed people with a permanently high and secure income.

- Civil servants as they receive subsidies from the state.

- High-earner individuals plan to stay for a few years in Germany.

You can check here how much one saves with private health insurance in different scenarios.

References:

- https://www.student-kv.de/krankenversicherung-student/

- https://www.minijob-zentrale.de/DE/die-minijobs/midijob/midijob_node.html

- https://www.finanztip.de/krankenversicherung/

- https://commission.europa.eu/strategy-and-policy/policies/justice-and-fundamental-rights/eu-citizenship/movement-and-residence_en